Proshare Nigeria

BMI Research

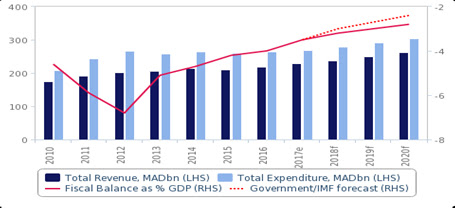

BMI View: Morocco’s fiscal deficit will narrow in the years ahead, albeit at a slower pace than in previous years. While strong economic growth will boost the country’s tax take; a series of new tax exemptions and elevated capital spending ensure fiscal consolidation will occur only gradually.

Polisario Digging In

These developments are likely to cause alarm for supporters of an independent Sahrawi Arab Democratic Republic (SADR), leading to a hardening in the position of the Polisario Front and Algeria, the group’s main backers. The day after Morocco was elected to the AU Peace and Security Council, Polisario Front troops conducted military man-oeuvres in a demilitarized zone established by the 1991 peace accords that brought the conflict between the two sides to an end. Polisario troops also closed a road in the zone and briefly detained a group of Moroccans travelling on it. The road was reopened following intervention by UN peacekeeping troops stationed in the region. We believe that regional and international pressure will prevent the two sides from returning to all-out conflict. However, a likely hardening in the position of the Polisario Front will make progress difficult in the international community’s attempts to find a lasting resolution to the crisis.

We expect Morocco’s fiscal deficit to continue to narrow in 2018, though the pace of consolidation will likely be more gradual than seen in recent years. Despite strong economic growth, total revenue growth will be somewhat subdued given the number of tax exemptions included in the 2018 budget.

Meanwhile, although the government looks poised to restrain the growth of recurrent expenditures, capital spending will remain elevated, in line with the government’s focus on improving infrastructure. This underpins our forecast for the fiscal deficit to come in at 3.3% of GDP in 2018. While representing an improvement on the estimated 3.5% shortfall recorded in 2017, this is still 0.3 percentage points larger than the government’s own target of 3.0%. The gradual progress on fiscal consolidation underpins our view that, even despite strong growth, Morocco’s debt-to-GDP.

Deficit to See Slower-Than-Targeted Reduction

Budget Balance, Total Revenue & Expenditure

Growing Economy Will Boost Revenues

Revenues are set to continue expanding over 2018, though more gradually than in recent years. Robust economic growth – we forecast real GDP growth of 3.8% in 2018 – will offer tailwinds to receipts (see ‘Positive Trajectory Still at Play Despite Modest 2018 Slowdown’, 17 October 2017). In 2017, revenue grew by an estimated 4.3% on the back of 2016 reforms that broadened the tax base and modernized tax administration. With tax earnings comprising well over 80% of total fiscal intakes, the strong economy will support revenue inflows ahead. We note, however, that the government’s budget plans for 2018 focus primarily on new tax exemptions rather than revenue-raising measures, which will limit tax revenue growth.

High Capital Spending Putting Upward Pressure on Expenditure Growth

At the same time, spending growth looks poised to remain relatively robust. We expect continued restraint in recurrent spending, with a slow reduction in the size of the public-sector workforce (by attrition) and efforts to limit wage growth through revised salary and promotion policies. However, recurrent spending cuts will be offset by significant capital spending growth. We forecast an increase of 8.0% compared to 2017, bringing it up to 25.8% of total expenditure – a relatively high figure by historical standards. Three initiatives will consume most of the funds: The Green Morocco project, which aims to reduce the impact of droughts by providing innovative technology to small-scale farmers; the national energy strategy; and regional development projects, including increased phosphate mining capacity and expanded highway systems. Ultimately, this elevated capital spending, coupled with the tax exemptions on the revenue side of the budget, suggest the fiscal deficit will narrow only to a limited degree.

Robust GDP Expansion Will Help Stabilize Debt Ratio

Although Morocco is unlikely to see a balanced budget in the medium term, we do not expect debt-to-GDP to increase from current levels. Public debt rose between 2010 and 2012 largely on the back of subsidy costs, which ballooned in response to spiking oil prices and public unrest. We believe debt-to-GDP has now peaked, stabilizing at 65.5% in 2018, and will slowly trend downwards over the medium term as GDP growth remains robust and some fiscal consolidation efforts – particularly continued constraint in recurrent expenditures – are maintained.