Proactive Investors – Jamie Ashcroft

“This is an exciting phase in the evolution of the company as the new team takes action to drive the Lixus opportunity forward,” Adonis Pouroulis said.

Chariot Oil & Gas Limited (LON:CHAR) acting chief executive Adonis Pouroulis highlighted an exciting phase in its evolution, as the company released its interim results.

During the period the company established a new executive team which emphasise new values, a new mission and energy for the company.

The company noted that it is targeting growth and positive change through investment in projects that are driving ‘the energy revolution’.

“This is an exciting phase in the evolution of the company as the new team takes action to drive the Lixus opportunity forward and bring in value-accretive new ventures that play into the energy transition theme,” Pouroulis said in a statement.

READ: Chariot significantly increases resources offshore Morocco

“With each day that passes more potential in the Lixus licence is uncovered, delineating a major gas resource with strong ESG credentials and national significance for Morocco.”

Chariot noted that new ventures are currently being evaluated defined.

At the Anchois project in Morocco, a key asset in Chariot’s portfolio, there was an upgrade to a total remaining recoverable resource which now exceeds 1trn cubic feet, after a 148% increase.

“The work the team has undertaken to advance the Anchois project during the period, in what is shaping up to be a multi-Tcf prospective licence area, has served to enhance its commerciality and bring a highly scalable, fundable development opportunity onto the radar of institutional financing,” Pouroulis said.

“We look forward to further project endorsements and hope to announce more progress in the coming months as the gap narrows between the market’s perception of the company and what management feel is currently a vastly undervalued clean energy investment proposition.”

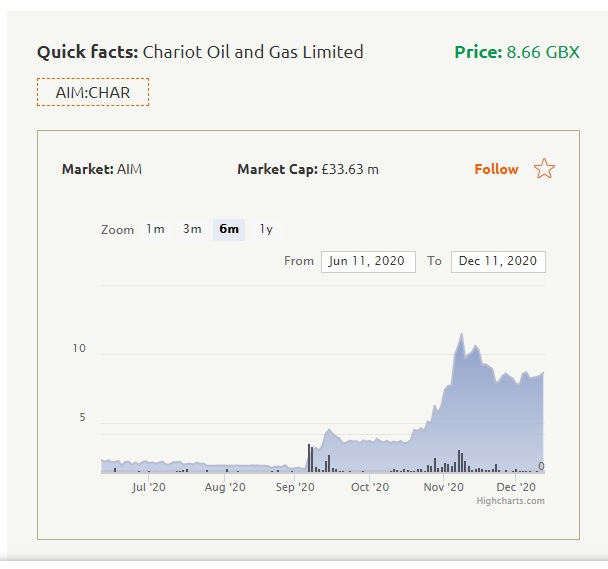

The shares rose 11% to 3.9p on Tuesday morning.

House broker Finncap said the results “represent something of a line in the sand for the new management team, with historic oil-focussed deepwater exploration spend written-off, demonstrating its recent corporate and strategic ‘reboot’, which has ushered in a more entrepreneurial approach.

“Strategy has shifted away from higher-risk frontier exploration in favour of opportunities that better fit the energy transition. With the annual cash burn cut 45% to US$2.5m, no remaining work commitments and period-end cash of US$5.8m, management has a clear path ahead to deliver on its ambitions.”