TSX VENTURE: ALTS

www.altus-strategies.com

Mr. Steven Poulton reports:

Altus Strategies Plc (AIM:ALS) (TSXV:ALTS) (OTCQX:ALTUF) announces the discovery of further copper and silver mineralisation at the Company’s 100% owned Agdz project (“Agdz” or the “Project“), located 14km southwest of the Bou Skour copper and silver mine in the eastern Anti-Atlas of the Kingdom of Morocco (“Morocco“).

Highlights:

- Further copper and silver discoveries at Agdz project in central Morocco

- New 450m long zone at Makarn North Prospect with grades up to 3.50 % Cu and 308 g/t Ag

- Discovery follows the previously announced ‘predictive mapping’ project

- Programmes at other prospects continue to generate encouraging results including:

- 3.59 % Cu and 149 g/t Ag from 1.4km long Makarn South Prospect

- 4.67 % Cu and 308 g/t Ag from 1.4km long Makarn North Prospect

- 2.45 % Cu and 2.25 % Cu from 2km long Amzwaro prospect

- 2.12 % Cu and 1.99 % Cu from 150m long Miniére Prospect

- Mapping and Induced Polarisation geophysical survey (‘’IP”) to be undertaken in Q1 2021

Steven Poulton, Chief Executive of Altus, commented:

“We are delighted to report on further discoveries at the Makarn North prospect, as well as continued positive exploration results elsewhere on our 100 % owned Agdz copper-silver project, located in the Eastern Anti-Atlas of Morocco. Makarn North comprises a 1.4km long prospect, with grades up to 4.67 % Cu and 308 g/t Ag from surface sampling. The discoveries are a result of the previously announced and pioneering ‘predictive mapping’ programme undertaken by Altus in partnership with the BRGM Campus at the University of Orléans in France.

“Agdz is located just 14km southwest of the Bou Skour copper and silver mine, which is operated by Moroccan state mining group Managem. While mineralisation hosted at Bou Skour is not necessarily indicative of that at Agdz, the Project is clearly exceptionally well located in an established and highly prospective mining district. The next phase of work at Agdz will include an IP geophysical survey to define targets for trenching and ultimately drill testing. We look forward to updating shareholders on progress in due course.”

Agdz Project: Sampling Programme

The most recent exploration programme at Agdz focussed on targets defined by the predictive mapping programme undertaken in partnership with the Bureau de Recherches Géologiques et Minières (“BRGM“) campus at the University of Orléansin France, as announced by the Company on 12 August 2020. The programme targeted the Makarn, Amzwaro, and Miniére Prospects.

The prospects identified at Agdz are summarised as follows:

- The Makarn Prospect: A swarm of mineralised dykes, shears and veins which predominantly strike NNE over a distance of 2.8km. Historical results include rock chip grades of 8.00 % Cu and 448 g/t Ag. This latest programme has defined a new prospect at Makarn North, which has a strike length of approximately 450m as defined by surface alteration (silica, chlorite, K-feldspar and epidote) and outcrop sampling including 3.50 % Cu and 308 g/t Ag.

- The Amzwaro Prospect: Multiple NNE and NNW trending structures within a zone up to 2km in length and 200m wide, bound by extensional structures. Individual alteration zones are up to 33m in width. Alteration comprises predominantly of chlorite and silica in breccia and veins. Historical results include rock chip grades of 4.82 % Cu, 189 g/t Ag and 1.91 g/t Au.

- The Minière Prospect: A 150m long and 90m wide area of historical underground artisanal mining, exploiting multiple sub-parallel copper bearing zones of alteration. Historical results include rock chip and spoil sample grades of 13.05 % Cu, 12.90 g/t Ag and 0.49 g/t Au.

- The Daoud Prospect: A series of NNW striking quartz veins and pervasive silicification, mapped discontinuously over a 700m strike length transected by ENE striking chlorite rich alteration zones. Historical results include rock chip grades of 2.71 % Cu, 152 g/t Ag and 2.96 g/t Au.

Sampling Methodology and Analysis

A total of 168 rock samples were collected from outcrop and 3 grab samples from spoil for the exploration programme described in this release. Of the samples collected 69 samples (40 %) were >10 g/t Ag, 66 samples (39 %) between 1 and 10 g/t Ag and 36 samples less than 1 g/t Ag (21 %).

All sample preparation was undertaken by ALS Global in Seville (Spain). Samples were then securely transported for assay by ALS Global Loughrea (Republic of Ireland). Given the early stage nature of these programmes no QAQC samples were included.

Rock samples were crushed with 70 % passing -2 mm. The less than 2 mm fraction was pulverized with 85% of the sample passing <75 microns. All samples were analysed for a multi element suit of 33 metals by Inductively Coupled Plasma Atomic Emission Spectroscopy (ICP-AES). In addition, all samples were analysed for their Au content by 50g Fire Assay method. Samples with more than 1 g/t Au were resubmitted for Fire Assay with a gravimetric finish.

Illustrations

The following figures have been prepared and relate to the disclosures in this announcement and are visible in the version of this announcement on the Company’s website (www.altus-strategies.com) or in PDF format by following this link: https://altus-strategies.com/site/assets/files/4953/altus_nr_-_agdz_10_dec_2020.pdf

- Location of Agdz and Altus’ exploration projects in Morocco is shown in Figure 1.

- Copper and silver results from recent sampling at Agdz are shown in Figure 2.

- Selection of photos from Agdz is shown in Figure 3.

Agdz Project: Location

The Company’s wholly owned subsidiary,Aterian Resources Limited, has a 100% interest in the 59.7km2 Agdz Project. The Project comprises four contiguous licence blocks in the Souss-Massa-Drâa region of the Anti-Atlas mountains of central Morocco, approximately 350km south of the capital, Rabat. The Project is approximately 14km southwest of the Bou Skour copper-silver mine and 80km southwest of the world-renowned Imiter silver mine, both operated by the Moroccan mining group Managem. Mineralization hosted on those properties is not necessarily indicative of mineralization hosted at Agdz.

The Project is located approximately 35km east of the city of Ouarzazate, where infrastructure and services are of a high standard, including a regional airport. The ‘Noor 1’ solar station, which is the world’s largest concentrated solar power plant with a planned output of 580 MW is located approximately 40km northwest of Agdz. The Project is accessed via a paved road and a network of unpaved roads and vehicle tracks close to and within the licence.

Agdz Project: Geological Setting

Agdz is proximal to the Oued Dar’a Caldera, which formed within a brittle pull apart structure along a northeast trending regional fault zone in the eastern Anti-Atlas. The caldera is located within the highly prospective Neoproterozoic Sidi Flah-Bou Skour inlier of the Saghro Massif, which developed during Pan-African tectonic events. This massif is comprised of a lower tightly folded volcano-sedimentary sequence formed from arc-related metagreywacke and metavolcanics lithologies deposited approximately 650Ma. The lower complex was intruded by diorite, granodiorite and lesser gabbro and monzogranite between 615Ma and 575Ma. The upper complex is comprised predominantly of felsic metavolcaniclastics related to the development of several calderas emplaced typically between 575Ma and 540Ma and is intruded by granitic plutons. The upper complex is gently folded, sitting unconformably on the lower complex. Regionally, ore deposits are commonly associated with the upper complex and are typically spatially related to magmatic emplacement.

The geology at Agdz comprises meta-sedimentary and meta-volcanic sequences. These belong to the upper complex and are cut by a series of sub-parallel NE to NW striking brittle faults and alteration zones, a number of which have been historically mined for copper. The alteration (comprising variably of chlorite, iron, silica, k-feldspar, actinolite, carbonate and barite) is generally located within brittle pull apart fault breccias and fracture zones, between (and oblique to) the mapped lineaments.

Mapping, sampling, trenching and ground magnetic surveys undertaken by the Company to date have defined four priority prospects at Agdz namely, Makarn, Amzwaro, Minière and Daoud. The Company has completed a series of 13 reconnaissance trenches at Agdz, totalling 576m in length and excavated to a depth of up to 1m. The trenches have revealed a number of NNE trending alteration zones in packages which are up to 33m wide, beneath a thin cover of soil and float material. Previously reported assay results from 5 of the 13 trenches have been received and reported to date and include 0.65 % Cu and 36.54 g/t Ag over 14.12m and 0.36 % Cu and 13.26 g/t Ag over 13.70m.

Qualified Person

The technical disclosure in this regulatory announcement has been approved by Steven Poulton, Chief Executive of Altus. A graduate of the University of Southampton in Geology (Hons), he also holds a Master’s degree from the Camborne School of Mines (Exeter University) in Mining Geology. He is a Fellow of the Institute of Materials, Minerals and Mining and has over 20 years of experience in mineral exploration and is a Qualified Person under the AIM rules and NI 43-101.

For further information you are invited to visit the Company’s website www.altus-strategies.com or contact:

Altus Strategies Plc

Steven Poulton, Chief Executive

Tel:+44 (0) 1235 511 767

E: info@altus-strategies.com

SP Angel (Nominated Adviser)

Richard Morrison / Adam Cowl

Tel: +44 (0) 20 3470 0470

SP Angel (Broker)

Abigail Wayne / Richard Parlons

Tel: +44 (0) 20 3470 0471

Yellow Jersey PR (Financial PR & IR)

Georgia Colkin / Charles Goodwin / Henry Wilkinson

Tel: +44 (0) 20 3004 9512

E: altus@yellowjerseypr.com

About Altus Strategies Plc

Altus Strategies (AIM:ALS)(TSX-V:ALTS)(OTCQX:ALTUF) is a mining royalty company generating a diversified and precious metal focused portfolio of assets. The Company’s focus on Africa and differentiated approach, of generating royalties on its own discoveries as well as through financings and acquisitions with third parties, has attracted key institutional investor backing. The Company engages constructively with all stakeholders, working diligently to minimise its environmental impact and to promote positive economic and social outcomes in the communities where it operates. For further information, please visit www.altus-strategies.com.

Cautionary Note Regarding Forward-Looking Statements

Certain information included in this announcement, including information relating to future financial or operating performance and other statements that express the expectations of the Directors or estimates of future performance constitute “forward-looking statements”. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. Such factors include without limitation the completion of planned expenditures, the ability to complete exploration programmes on schedule and the success of exploration programmes. Readers are cautioned not to place undue reliance on the forward-looking information, which speak only as of the date of this announcement and the forward-looking statements contained in this announcement are expressly qualified in their entirety by this cautionary statement.

Where the Company expresses or implies an expectation or belief as to future events or results, such expectation or belief is based on assumptions made in good faith and believed to have a reasonable basis. The forward-looking statements contained in this announcement are made as at the date hereof and the Company assumes no obligation to publicly update or revise any forward-looking information or any forward-looking statements contained in any other announcements whether as a result of new information, future events or otherwise, except as required under applicable law or regulations.

TSX Venture Exchange Disclaimer

Neither the TSX Venture Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

Market Abuse Regulation Disclosure

Certain information contained in this announcement would have been deemed inside information for the purposes of Article 7 of Regulation (EU) No 596/2014 (“MAR“) until the release of this announcement.

Glossary of Terms

The following is a glossary of technical terms:

“Ag” means silver

“Au” means gold

“BRGM” means the French Bureau de Recherches Géologiques et Minières

‘’Cu” means copper

“g” means grams

“g/t” means grams per tonne

“grade(s)” means the quantity of ore or metal in a specified quantity of rock

“ICP-AES” means Inductively coupled plasma atomic emission spectroscopy analytical technique

“km” means kilometres

“m” means metres

‘’Ma” means Mega-annum which is equal to one million years

“NI 43-101” means National Instrument 43-101 “Standards of Disclosure of Mineral Projects of the Canadian Securities Administrators”

“ppm” means parts per million

“QAQC” means Quality Assurance and Quality Control

“Qualified Person” means a person that has the education, skills and professional credentials to act as a qualified person under NI 43-101

RECENT & RELEVENT

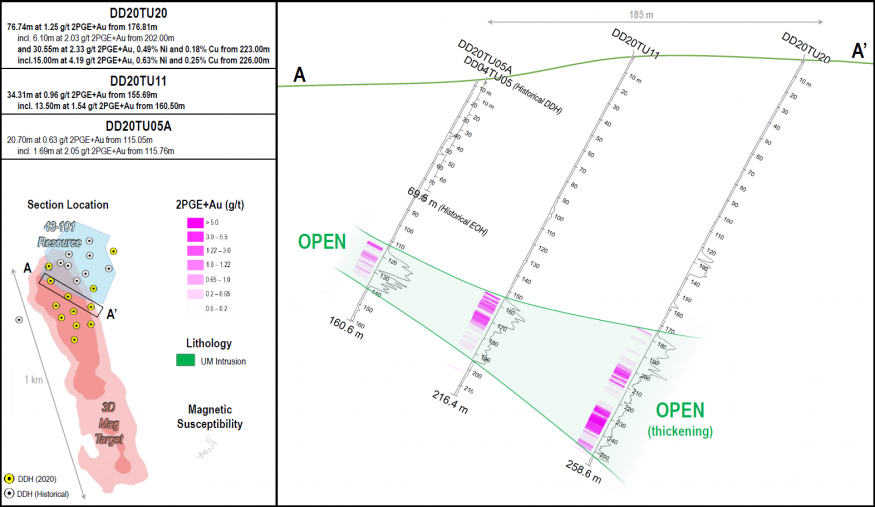

ValOre Metals Drills 76.74 metres of 1.25 g/t 2PGE+Au, incl. 15.00 m at 4.19 g/t…

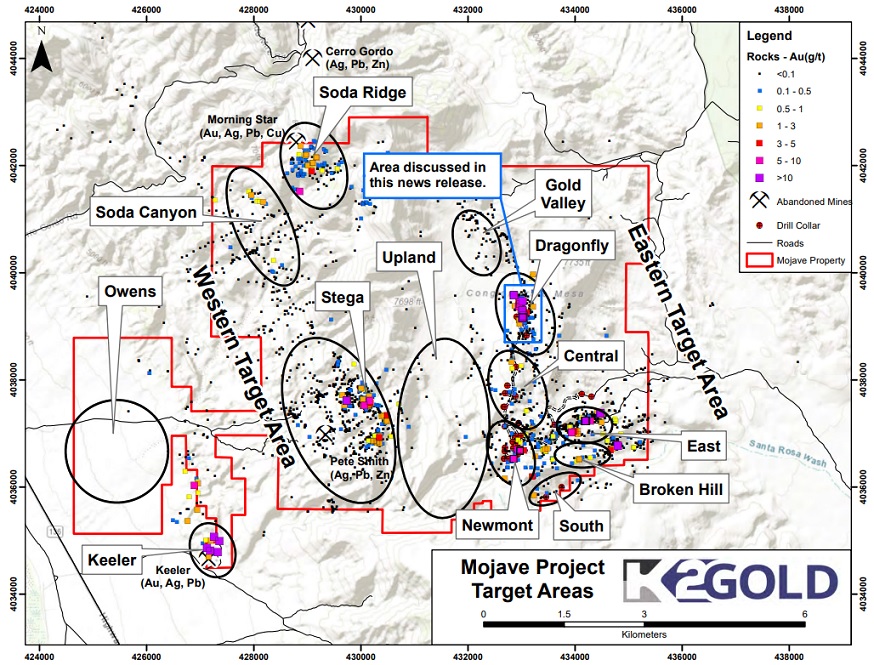

K2 Gold Drills 86.9 m of 4.0 g/t Gold from Surface at Mojave

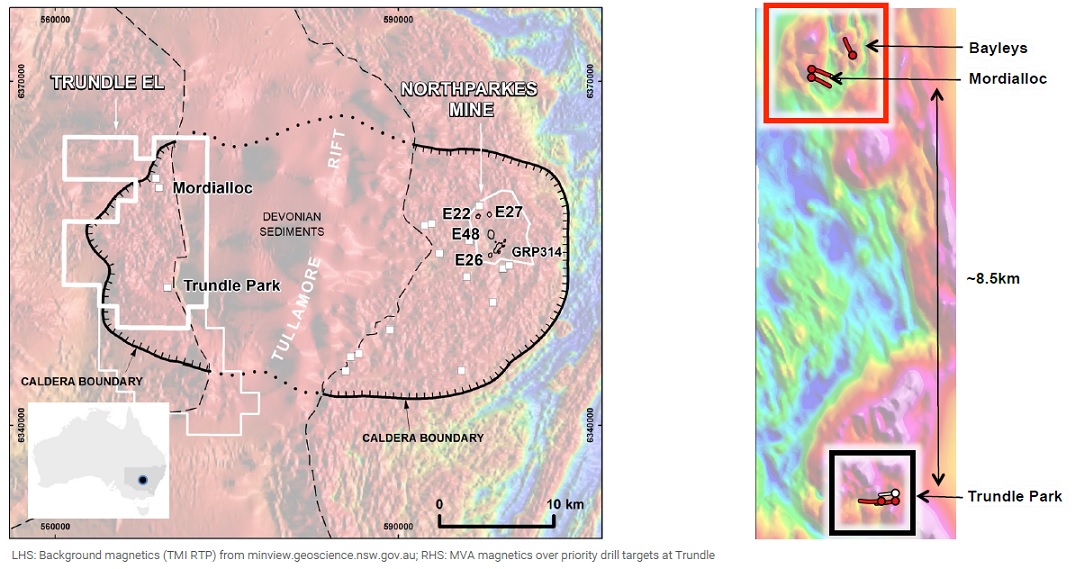

Kincora Copper intersects broad mineralized zones at Trundle

MORE MINING NEWS

Elemental Royalties Doubles in Asset Size With Agreement to Acquire Gold Royalty Portfolio From South32 and Announces $12 Million Bought Deal Private PlacementNovo Resources Confirms Delivery of Steinert KSS Mechanical Sorter and Provides Operational Update From Beatons CreekLabrador Gold Announces Assays From Area Around Visible Gold Discovery at KingswayRevival Gold Intersects Near-Surface Oxide Gold in an Additional Eleven Drill Holes at Beartrack-ArnettK2 Gold Drills 86.9 m of 4.0 g/t Gold from Surface at MojaveValOre Metals Drills 76.74 metres of 1.25 g/t 2PGE+Au, incl. 15.00 m at 4.19 g/t 2PGE+Au, 0.63% Ni and 0.25% Cu at Pedra BrancaWallbridge Mining Intersects 5.07 g/t Au over 100.6 metres, including 29.03 g/t Au over 7.30 metres in the Tabasco-Cayenne ZonesGreat Bear Resources Drills 101.50 m of 4.69 g/t Gold, Including 5.25 m of 41.25 g/t Gold at LP Fault; Provides Update on Successful Model TestArizona Metals Corp Announces Drilling at Its Sugarloaf Peak Heap-Leach Gold-Oxide Project in La Paz County, Arizona Intersects 122 m of 0.31 g/t Gold From Surface, Including…K2 Gold Completes Phase 1 Drilling Program at Mojave and Samples New Large Regional Gold TargetProsper Gold Corp. outlines several gold-in-till anomalies and samples high-grade gold at multiple prospects at Golden Sidewalk – Red Lake, ONClarity Gold to Acquire the Destiny Project Located in the Abitibi Region