- Central bank likely to hold benchmark rate at record-low 1.5%

- Businesses, citizens press demands as pandemic hits economy

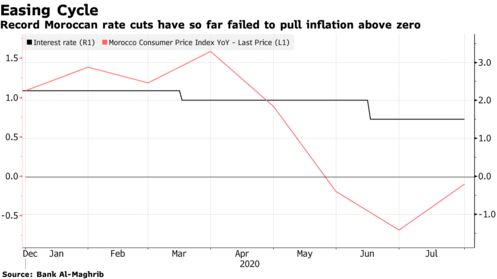

The economic disruptions caused by the spread of the coronavirus are exposing the limits of monetary policy in Morocco, with inflation staying below zero even after the central bank’s biggest interest-rate cut in history.

An easing cycle that started in March has done little to get the $119 billion economy back on track just as other defenses are proving inadequate and virus cases surge. Reducing the benchmark from a record-low 1.5% this week would amount to a “meaningless announcement” in the current climate, said Abdelouahed El Jai, a former central bank director.

“The overall picture has deteriorated since the last cut in June but the trend predates the pandemic,” said El Jai, now the chief economist at Cerab, a think tank in the capital, Rabat.

Limited room for further easing will likely prompt central banks from Nigeria to Thailand to hold rates this week. In Morocco, just over half of local investors polled by a unit of the kingdom’s largest lender expect the benchmark to stay unchanged after 75 basis points of cuts this year.