Interfax Energy

The Moroccan government plans to award a single contract for its integrated LNG and gas-to-power project, but financing a project of this size in Morocco will be far from straightforward.

The giant project, first mooted in late 2014, aims to meet the country’s rising energy demand and will feature a 5 billion cubic metre per year LNG import facility at Jorf Lasfar, along with several combined-cycle gas turbine (CCGT) power plants.

By the energy ministry’s own estimates, the project’s capital costs will hit $4 billion – excluding the jetty, which it will fund itself. This includes $800 million for the LNG terminal, $600 million for the pipelines, $400 million for gas storage and $2.2 billion for the CCGTs.

Securing commitments for a project of this size could be difficult and will require a high level of cooperation between partners. Morocco may struggle to convince companies the project is bankable.

Morocco’s Ministry of Energy, Mines and Environment confirmed to Interfax that groups of companies would be invited to submit bids to build the entire project.

“It will be tendered as one integrated project through one tender,” said Lahsen Amarof, head of the ministry’s Natural Gas and Fossil Fuels Division. “We expect to have a consortium with many companies, including CCGT specialists and companies for the LNG part.”

The consortiums will each submit one price for power production to the electricity and water bureau (ONEE). Offers will be calculated based on the cost of constructing the LNG and power facilities, and importing the fuel. “ONEE will purchase the produced power for 20 or 25 years,” said Amarof. “The consortium will be paid for the power per kWh.”

When asked why Morocco is attempting to award a single contract for the scheme, Amarof said it was designed to save time and promote integration among the different parts of the programme.

Projects in other countries – most notably China and India – have been tendered under a similar structure for the same reason, Alex Tertzakian, an analyst for Energy Aspects, told Interfax. “Given the highly integrated nature of the project, it makes sense that it be offered under one tender,” he said.

High costs and risks

Even so, Morocco will need to convince private companies to manage the high costs and risks associated with the scheme. The sponsors will be responsible for selling 30% of the gas imported as LNG to industrial users under the current model. At the same time, it is unclear what price will be paid for the LNG, as Morocco is in the early stages of negotiating supply contracts.

“Morocco is in negotiations with some countries and companies that are suppliers,” said Amarof. “We need [to sign agreements with] Qatar, Russia or a private company. If we can, we will sign long-term agreements for the whole volume. If we have only a part of this volume, the rest will be tendered as supply contracts.”

Morocco’s gas import requirements are similarly uncertain as its piped gas supply contract with Algeria will expire in 2021. The fate of the last two CCGT plants in the scheme depends on the renewal of this agreement.

The support of international development banks would be an asset to a project of this size, but their participation will depend on how the project is structured. “Depending on project scope and structure, IFC [International Finance Corp.] would be interested [in supporting] private sector companies wishing to invest in the different segments of the gas value chain, including LNG import infrastructure and gas-fired power plants,” a spokesperson for the IFC told Interfax.

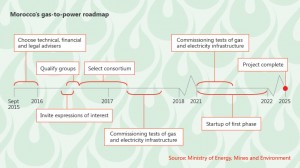

Technical advisers have until mid-October to submit bids to assist ONEE on the project. It will then seek legal and financial consultants.

Under Morocco’s new national energy strategy, annual gas consumption is expected to rise from 900 million cubic metres (MMcm) in 2014 to around 3.5 bcm by 2025. Refining activities will require an additional 1 bcm/y while industry, concentrated around Jorf Lasfar, Mohammedia and Kenitra, will add another 0.5-1 bcm.

New power plants – with a total capacity of 2.4 GW – will convert 70% of the gas from the LNG terminal into electricity. “Morocco’s plans to integrate a new LNG regasification terminal with a CCGT stems from their desire to diversify their energy mix and to reduce their dependence on coal and oil imports,” said Tertzakian.

Several potential sites have been identified for CCGTs: Jorf Lasfar, Dhar Doum, Oued El Makhazine, Al Wahda and Tahaddart. Each could accommodate 1.2 GW of new capacity – except Tahaddart, where a 600 MW unit could be installed.

The project also includes the construction of a 400-km high-pressure pipeline connecting the LNG terminal to the existing Maghreb-Europe pipeline, which takes Algerian gas to Spain via Morocco, through Mohammedia, Kenitra and Dhar Doum. The scheme also includes the construction of pipelines to each of the power stations, and may be extended to underground gas storage facilities at a later date.