By Russ Quinn

DTN Staff Reporter

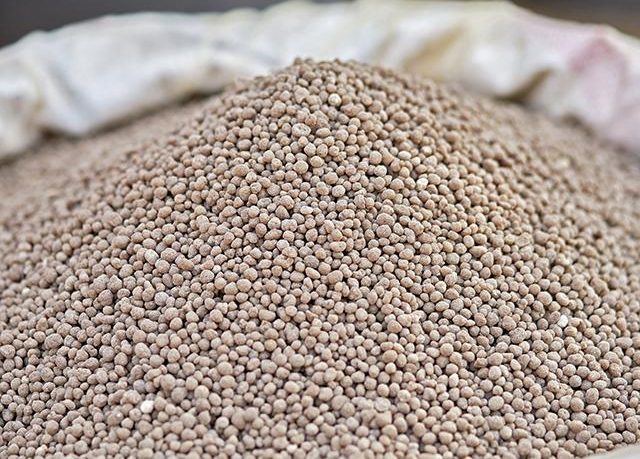

The U.S. International Trade Commission (USITC) issued a ruling on Thursday in which countervailing duties will be ordered on Russian and Moroccan phosphate imports. (DTN/Progressive Farmer file photo)

The U.S. International Trade Commission (USITC) on Thursday determined that phosphate fertilizer imports from Morocco and Russia have affected the U.S. market, and a countervailing duty should be placed on imports from these countries. The ruling comes a month after the U.S Department of Commerce recommended the countervailing tariffs on imported phosphorus fertilizer should be instituted.

The USITC vote was 4-1 in favor of the countervailing duties. The U.S. Department of Commerce will issue the duty orders on phosphate fertilizers for at least five years. The rates for such imports are expected to be approximately 20% for Moroccan producer OCP, 9% for Russian producer PhosAgro, 47% for Russian producer EuroChem and 17% for all other Russian producers, according to a Mosaic news release.

Mosaic filed petitions in June 2020 to request the start of countervailing duty investigations. The company maintained foreign subsidies are unfair and that these duties would restore competition in the U.S. market.

“Today’s decision upholds our belief that fair trade is the cornerstone of a healthy U.S. economy, and that American farmers will benefit from having a more competitive American fertilizer industry,” a Mosaic news release said.

On the other side of the issue, OCP believed there were no grounds for imposing countervailing duties on Moroccan fertilizer imports. Earlier news releases said OCP would cooperate with U.S. authorities.

An OCP news release from Thursday said the company disagrees with the ruling.

“This decision comes despite the arguments presented by the OCP group demonstrating that there is no basis for such duties, as well as significant voices opposed to Mosaic’s petition from across American agriculture — distributors, associations and cooperatives — and elected officials in the Senate and House of Representatives,” the news release said.

Leaders from the American Soybean Association, National Corn Growers Association and National Cotton Council of America had written the U.S. International Trade Commission last month warning that tariffs on imported phosphate (phosphorus) fertilizers would adversely affect crop production in the country (https://www.dtnpf.com/…). The commodity groups warned that new duties on imported phosphate fertilizers would raise prices more than $80 a ton.

The U.S. imported just under $1.03 billion in phosphate fertilizers in 2019 from Morocco ($729.4 million) and Russia ($299.4 million). Import volume from Morocco was 2 million metric tons, up about 11% from 2018. Phosphorus imports from Russia were 729,288 metric tons, down about 16% from 2018 shipments.

With separate tariffs on Chinese phosphate fertilizers, that effectively leaves about 15% of the global phosphate market open to U.S. farmers without some form of import tariffs.

Despite disagreeing with the decision, OCP said they recognize the supply challenges that U.S. farmers face. The company will serve American producers in the future while exploring the most appropriate options to do so, according to the news release.

Because of several factors, including this trade dispute, increasing grain prices and increasing demand for phosphate fertilizer globally, phosphate fertilizer prices have risen sharply since last summer.

On the wholesale market, prices rose dramatically at the beginning of 2021. New Orleans, Louisiana, MAP in January traded as high as $550 per ton FOB (free on board — the buyer pays for transportation of the goods), up over $130 per ton from the end of December, while DAP rose over $150 per ton from the previous month’s lows (https://www.dtnpf.com/…).

U.S. phosphate prices fell somewhat at New Orleans in February after the U.S. Department of Commerce released its final subsidy rates for potential countervailing duties to be imposed on Moroccan- and Russian-origin phosphates, taking some of the guesswork out of margins for those sources, according to Logan Garcia, market reporter – Fertecon, Agribusiness Intelligence, IHS Markit (https://www.dtnpf.com/…).

The retail fertilizer markets have also seen significantly higher phosphate fertilizer prices as well.

Both DAP and MAP retail prices are considerably higher from a year ago. The average retail price of DAP is up 49%, while MAP is 56% higher compared to last year (https://www.dtnpf.com/…).

DTN Ag Policy Editor Chris Clayton contributed to this article.

Russ Quinn can be reached at russ.quinn@dtn.com

Follow him on Twitter @RussQuinnDTN

(c) Copyright 2021 DTN, LLC. All rights reserved.