Global Risk Insights

by Senior Analyst Jeremy Luedi

From trade to tourism, Morocco is quickly becoming a media darling in China, as the country’s stability, location and culture entice Chinese investment.

Chinese involvement and investment in Africa is well documented, with Beijing a major trading partner for the continent’s resource exporters. One of the latest countries to benefit from China’s attentions is Morocco, which is witnessing an unprecedented boom in bilateral relations. Morocco is quickly becoming an important partner for China on a range of issues: one can even say that Morocco-fever is gripping the Middle Kingdom.

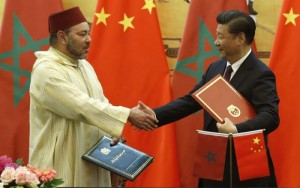

Despite being only the second African country to recognize the People’s Republic of China in 1958, Morocco has until recently been overshadowed by the likes of Angola, and closer to home, by Algeria. Lacking substantial oil reserves, Morocco took a backseat during China’s resource binge in the 2000s, but has since seen an outpouring of Chinese interest as Beijing seeks to diversify its investments in the region. Morocco’s rise in popularity can be traced to King Mohammed VI’s visit to China in 2016, a trip which is credited with jump-starting bilateral ties: Morocco now boasts three Confucius Institutes.

China and Morocco’s shared stances on non-intervention make them compatible partners, as does the fact that Morocco has not been overly critical of China, despite being a Major Non-NATO ally of the United States. China’s refusal to comment on the Western Sahara issue (a contested region claimed by Morocco) meshes nicely with Morocco’s silence on China’s actions towards its Muslim population in Xinjiang. While some Moroccans bemoan the plight of their co-religionists in China, Rabat has not openly voiced these concerns. Likewise, by refraining from commenting on the Western Sahara issue, China distinguishes itself from other external partners like the AU, EU and U.S which have all raised concerns about Moroccan actions in the region.

Alongside mutual non-interference, Morocco is also increasingly benefiting from Chinese efforts to diversify its foreign investment, especially regarding technology and tourism.Morocco is also becoming the default investment destination in North Africa, as the region continues to be unstable, with Morocco reaping the benefits of stability. Moreover, growing anti-Chinese sentiment in more established China-Africa relationships is also leading China to diversify its investment portfolio to hedge against anti-Chinese protests and backlashes that threaten existing investments. To this end Casablanca will be hosting the China-Morocco Trade Week in December 2017.

China on a spending spree in Morocco

Alongside traditional exports to China such as phosphates, Morocco is seeing a tidal wave of Chinese investment in a host of sectors. Between 2011 and 2015 Chinese FDI in Morocco increased 195%, with a 93% increase between 2014 and 2015 alone. Since then things have only continued to accelerate. The Chinese-built 952 metre King Mohammed VI bridge (itself part of the 42 km Rabat motorway bypass expansion) was opened in July and in November 2016, China’s Chint Group Corp was chosen to construct a 170MW solar plant. Furthermore, Moroccan authorities met with China Railway in December to discuss the construction of a multi-billion, high-speed rail link between Marrakesh and Agadir.

Sino-Moroccan fusion: Vogue China July 2014

The Bank of China opened an office in Casablanca in March 2016 as part of Morocco’s Casablanca Finance City initiative.Similarly, Yangtse Automobile has announced a $100 million investment (expected to create 2,000 jobs) in Tangier to produce electric cars and buses for export to Europe, citing Morocco’s location as an asset in boosting exports to Europe while also shortening supply chains. Tangier is also the location of Morocco’s ambitious $10 billion Tangier technology hub project. Aided by a $1 billion investment from China’s HAITE Group, the project aims to build a smart city with 300,000 residents and provide 100,000 jobs in order to create a new technology and manufacturing hub near Tangier. The project is expected to attract investment from some 200 foreign companies, many of them Chinese.

Another growth market are citrus exports to China. As the third largest citrus exporter, Morocco has needed to seek out new markets in the wake of Russia’s agriculture import ban, with China a perfect candidate. The first batch of high-end Moroccan citrus exports set out for Shanghai in November. Copag – Morocco’s largest citrus producer – has partnered with Chengdu’s Bideng Trade Co.to sell Moroccan fruit in China. The growing demand for foreign food in China – spurred by rising incomes and health concerns regarding Chinese produce – provides an excellent opportunity. Given Morocco’s existing integration into EU food supply chains, Rabat is already beholden to high quality standards, a fact that appeal to many Chinese consumers. Indeed Chinese importers have cited Morocco’s ability to pass the EU Proficiency Test for Pesticide Residues as a seal of confidence.

Indeed China’s interest in all things Moroccan has even seen the African country begin to export donkeys to meet the demand of China’s traditional medicine market. China is importing more than 80,000 donkeys (and growing) from across Africa to supply hide and gelatin for traditional medicines, as Beijing’s annual consumption of 1.8 million animals remains insufficient.

Moroccan tourism and culture take China by storm

Alongside manufacturing and other investments, the most explosive growth has been in the tourism sector. Even before Rabat’s decision to drop visa requirements for Chinese visitors in July 2016, Ctrip as part of the 2016 National Day Travel Prediction Report predicted a 3500% increase in visa applications to Morocco. As a result by November 2016, Morocco saw a sixfold increase in Chinese arrivals – a fact all the more impressive given that no direct flights exist between the two countries. With 42,000 Chinese tourists in 2016 – a 300% year-on-year increase from 2015 – Morocco has announced a goal of 100,000 visitors from the Middle Kingdom in 2017. As a result, Chinese investors from Guangzhou met with the Moroccan Society of Tourist Engineering in late February to discuss investments in hotels, resorts, spas and amusement parks.

All this comes as China’s government-run Global Times declared Morocco the best potential destination for 2017, based on visa procedures, tourist flows, and tourist satisfaction. This has resulted in Morocco becoming a trending topic on Weibo, with photos of the North African country especially popular. This trend has been fostered by a partnership between Morocco and Chinese smartphone maker Xiaomi, whose team travelled to Morocco to snap promotional photos for its latest smartphone. Morocco has become the star model to showcase the 23 mega-pixel camera on Xiaomi’s M1 Note 2 smartphone. Photos of Morocco were prominently featured during Xiaomi’s November launch conference for the M1 Note 2. An added bonus for Morocco is that Xiaomi is providing the photos for free as pre-installed content on its phones, thus introducing Morocco to tens of millions of Chinese consumers.

Morocco was also a star attraction at the Beijing International Book Fair in August, marking Morocco’s second consecutive appearance at the event. On the other hand,The Donor by Chinese director Zang Qiwu won the top prize at the 2016 Marrakech Film Festival in December. The amount of hype surrounding China-Morocco relations and cultural exchanges has even led to the spread of fake news, with Chinese media incorrectly reporting that author Liu Zhenyun had won a popular Moroccan literary prize. This was no mere typo, as the alleged prize does not even exist, with Chinese officials having to debunk the story.

Whether this was an orchestrated effort to reinforce the trending China-Morocco narrative that backfired, or simply a viral rumour sparked by an excited netizen, it demonstrates that Morocco is clearly top of mind in China.

Under the Radar uncovers political risk events around the world overlooked by mainstream media. By detecting hidden risks, we keep you ahead of the pack and ready for new opportunities.

Under the Radar is written by Senior Analyst Jeremy Luedi.