Morocco’s central bank delivered its biggest interest-rate cut in history and exempted lenders from holding cash in reserves, looking to jolt an economy gradually emerging from a three-month lockdown with much uncertainty still ahead.

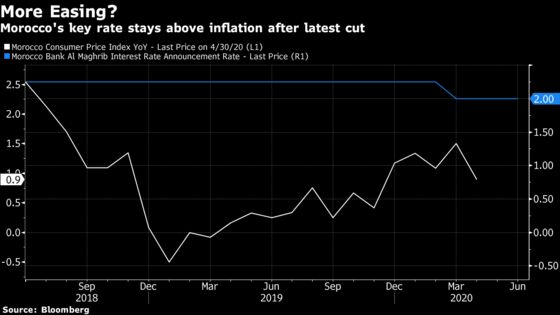

Adding to the 50 basis-point reduction that brought the benchmark rate to a record low 1.5%, Bank Al-Maghrib also removed a requirement for commercial lenders to set aside 2% of their deposits. Governor Abdellatif Jouahri said the latter move will unlock 10 billion dirhams ($1 billion) in extra liquidity for banks.

The surprise expansion of stimulus adds to an easing cycle that began in March and reflects the hardship facing the North African kingdom. While slowly reopening its economy after grounding flights and closing cafes, restaurants and even mosques in March, it’s also having to contend with an acute drought that’s hit the key agriculture sector.

“Growth this year will suffer from the dual effects of the drought and the measures that were put in place to counter the spread of Covid-19,” Jouahri said.

With Morocco facing its weakest economic growth in a generation, the central bank moved in March to cut the key rate by a quarter-percentage point in its first rate reduction since 2016. Jouahri said officials also decided to lower lenders’ common equity tier 1 ratio — a key measure of financial strength — by 50 basis points to 8%.

- The central bank projects the economy will contract 5.3% in 2020

- Revises inflation forecast for 2020 to around 1% from 0.7%

- Budget deficit seen at 7.6% of GDP in 2020 versus 4.1% in 2019

- FX reserve assets seen at 218.6 billion dirhams in 2020, enough to cover five months of imports

- FX reserves projections take into account planned sovereign bond issues

Bank Al-Maghrib said it may call an unscheduled policy meeting before it’s next due to convene on Sept. 22.

The rapid-fire rate cuts mark a change for an institution known to favor caution, according to Abdelouahed El Jai, a former central bank director who predicted a cut of as much as 50 basis points.

“However, it says more about the difficult economic conditions Morocco is facing than it does indicate a shift in monetary policy,” El Jai, now the chief economist at Cerab, a think tank in the capital, Rabat, said in a phone interview.

(An earlier version of this story corrected the central bank’s inflation forecast.)