Mining weekly

by Megan Van Wyngaardt

A completed definitive feasibility study (DFS) has established that the Achmmach project, in Morocco, will only need $61.7-million for development, rather than the previously estimated $131-million, owner Kasbah Resources reported on Friday.

“Establishing the project in a weak financing, commodity and equity market created a significant impost to project development,” the ASX-listed company said in a statement, adding that it used the DFS to investigate a lower-cost development model.

The project now also has an estimated ore reserve of 6.56-million tons, at a grade of 0.85% tin for 55 500 t.

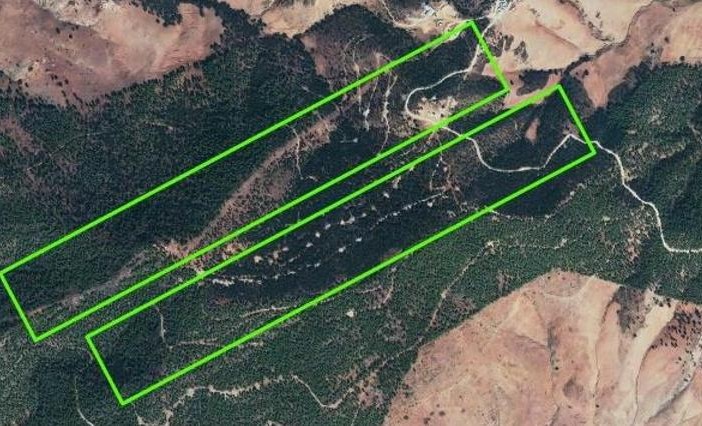

This high-grade underground operation is now technically and commercially feasible and will be mined in two stages. The first stage of production is aimed at unearthing 1.89-million tons at a grade of 0.96%, while the second stage of production will focus on 4.67-million tons at 0.80%.

The ten-year project is expected to have an all-in sustaining cost of $11 541/t of tin.

“The more modest capital requirements of a small-start option (SSO), higher early run-of-mine grades and the competitive operating cost profile for the project confirm the staged development as a lower risk, more robust development proposition than the one-million–ton-a-year model previously considered,” the company said.

The SSO can provide an operating platform that produces tin concentrates profitably across the lower range of recent tin prices and be expanded to increase returns.

Once a project-financing package has been agreed upon, joint venture (JV) partner Atlas Tin can make a decision to mine. Following this, project partners Toyota Tshusho, which holds 20% and Nittetsu, which holds 5%, will be required to fund their combined 25% of the total project costs. Kasbah will carry the remaining 75%.

Over the next six months, Atlas Tin JV will work towards finalising offtake and debt-financing discussions with selected parties while it will also seek to start front-end engineering and design for the project.

This will include the recruitment of a construction and mine management team, the completion of a detailed mine and process design, finalising the underground contract, finalising construction permitting and preparing tender documents for supply of long lead items.

EDITED BY: Mariaan Webb CREAMER MEDIA SENIOR RESEARCHER AND DEPUTY EDITOR ONLINE