Asharq Al awsat

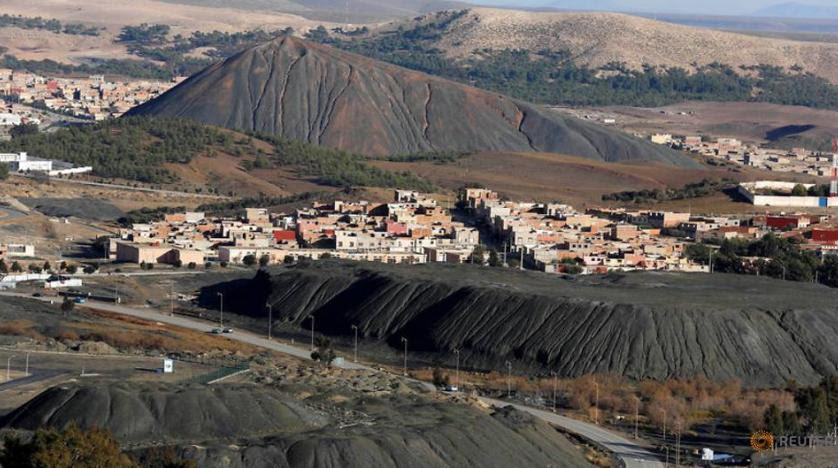

A general view shows a part of Jerada, Morocco, January…

Rabat – Asharq Al-Awsat

The International Islamic Trade Finance Corporation (ITFC), member of the Islamic Development Bank Group (IsDB), has signed a memorandum of understanding (MoU) concerning cooperation in trade development and trade capacity enhancement.

The cooperation forms part of ITFC’s Arab-Africa Trade Bridges (AATB) Program which was officially launched last year in Morocco under the patronage of King Mohammed VI, where it was agreed to hold the First Meeting of the Governing Board of the AATB in Morocco, in order to develop a general framework for the development of bilateral and regional cooperation and coordination.

The agreement was signed between ITFC CEO, Hani Salem Sonbol, and Secretary of State to the Minister of Industry, Investment, Trade and Digital Economy in Charge of Foreign Trade, Rakiya Eddarhem.

The agreement aims to facilitate the design, financing and implementation of technical assistance and capacity-building programs and the development of international trade. It also seeks to put in place structures that will contribute to the strengthening of the human and institutional capacities of Morocco.

Sonbol indicated that, in addition to the implementation of the AATB Program, cooperation between ITFC and Morocco would include a number of other projects to advance trade development in the member countries.

The CEO emphasized the important role Morocco has in leading major initiatives that contribute to the development of Africa.

In her statement, Eddarhem indicated that Morocco has been supporting AATB program since its launch in 2017, asserting: “we will continue to work together towards strengthening economic partnerships between Arab countries and African countries.”

She noted that the signing of this MoU consolidates this partnership and is in line with the Kingdom’s strategy to increase trade flows between Morocco and the rest of the African countries.

The AATB Program is a three-year regional trade promotion program aimed at improving cross regional trade between Arab countries and Sub-Saharan Africa.

ITFC is an autonomous entity within the Islamic Development Bank Group created with the purpose of advancing trade to improve the economic condition and livelihood of people across the Islamic world.

It commenced operations in January 2008 and united the trade finance activities under a single umbrella increasing the Corporation’s efficiency in service delivery by enabling rapid response to customer needs in a market-driven business environment.

Related News

Saturday, 3 November, 2018 – 11:30 –

Egypt: Dairy Sector Develops Rapidly as Animal Protein Prices Rise

An employee works with juice and milk products at a Juhayna factory on the outskirts of Cairo, Egypt, May 24, 2016. REUTERS/Mohamed Abd El Ghany

Cairo – Asharq Al-Awsat

Dairy is a basic protein source for Egyptians due to its cheap prices compared to other animal protein sources.

Tetra Pak statistics revealed that Egyptians consume more than 60 tons of dairy annually. However, the impact of reforms on the purchasing power affected the outcomes of firms.

Mohammed Al-Damati, a member of the Chamber of Food Industries, told Asharq Al-Awsat that the local market has recovered currently from the fallout of the instability in the past years.

He hoped that the purchasing power of consumers in Egypt will not be affected by the government’s economic reforms, revealing that conditions had started to improve since September.

Damati noted that Arab markets come first place in terms of total exports, specifying that Libya ranks first among them in dairy exports, followed by Jordan then Saudi Arabia.

Juhayna Food Industries profits in the third quarter of 2018 reached EGP111 million (USD6.2 million), a rise of 33 percent compared to the same period last year.

This result was supported by the growth of revenues and the continuity of efficiently recruiting operating costs and reducing indebtedness.