AME INFO

Last year, customers in the MENA region bought approximately 40 million cars, compared to China which racked in 24 million cars in sales, according to Statista. gas goes to show that Middle Eastern people love cars, so much so, that Jordan will build a car manufacturing factory worth $1.5bn to quench the Arabian thirst.

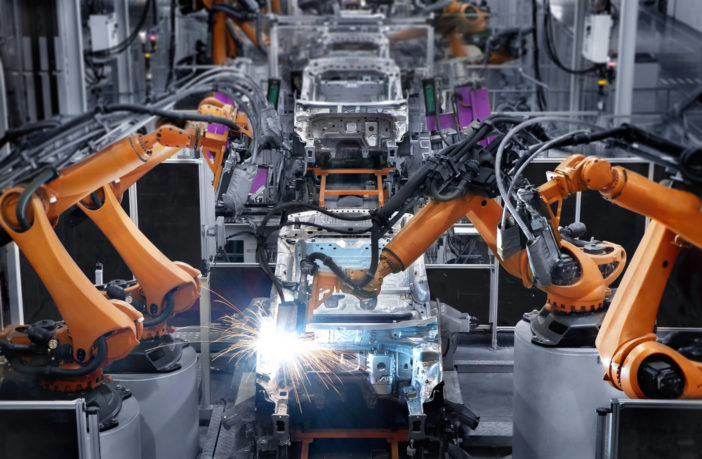

The news came from SIAG, the automotive company, saying that they signed a MoU with Aqaba Special Economic Zone Authority (ASEZA) to build a car plant that will potentially produce approximately 50,000 vehicles annually, according to Zawya.

Read: Lebanon’s struggling economy: High time something is done

What does this mean?

The MoU designates a special estate for automobile manufacturing in Aqaba, including the establishment of an automobile factory at the cost of $477 million in the first phase.

ASEZA Chief Commissioner Nasser Shraideh said that the $477 million is the investment volume of the initial phases of the project, whose investment volume in the first five years will reach approximately $6 billion.

The plant expects to provide a boost to the country’s GDP while also lowering the unemployment rate which reached a flat 18% in the last 18 months but had a 3% average jobless growth YoY from 2015 to 2017.

“The chief commissioner explained that the free trade agreement between Jordan and the US contributed to attracting such a “mega-investment,” where 70% of its workforce will be local,” said Zawya.

Rashed also underlined the fact that Jordan is the only Arab country that has free trade agreements with the US and the European Union, which enables vehicles manufactured in the Jordanian Kingdom to enter these markets.

Initial phases of the project will produce two types of vehicles: an SUV (operating on gasoline and electric) and light-duty pickups (both gasoline and diesel).

While Jordan is making waves with this, the GCC is gearing to become a significant player in car exports within the region.

Read: Where are oil prices heading and what is controlling them?

A (super) car industry?

W Motors, which started in Lebanon, will make the leap from manufacturing in Italy to manufacturing in the UAE in 2020, according to their announcements.

Previously, the plans were to build and start production in 2016 but soon after the company changed gears and decided to drive it all the way to 2020. W Motors plans to produce 200 cars annually.

Another GCC producer is Saudi which “will begin establishing a car manufacturing city in the coming year, along with providing a slew of advantages and incentives for investors,” the Ministry of Energy, Industry and Mineral Resources said.

The kingdom has a raft of raw materials that will help in building this city, including aluminum, liquefied aluminum, rubber, and plastics, the ministry added in a Twitter post.

This procedure will contribute to increasing Saudi and foreign investments in the auto manufacturing sector, in addition to raising exports and reducing imports.

Abdul Latif Jameel (ALJ) and Japanese company Kosei Aluminium (Kosei) have also signed a Memorandum of Understanding (MOU) with the National Industrial Clusters Development Program (NICDP), aimed at driving foreign investment into Saudi Arabia’s auto manufacturing sector.

Long-term plans for the venture involve the establishment of a factory in Saudi Arabia, as a global hub for Kosei, contributed by Saudi Arabian Mining Company (Ma’aden).

Read: Construction in Dubai has a new mantra: It’s not about going big

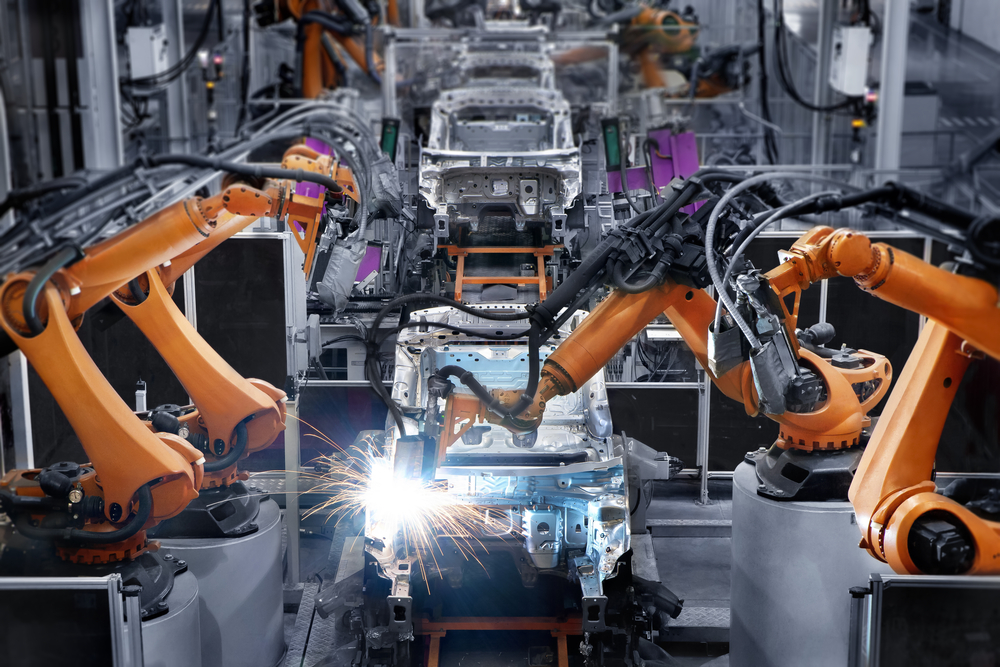

North Africa’s Morocco boasts a car manufacturing facility owned by Renault.

SOMACA (Société Marocaine de Constructions Automobiles) is a Moroccan car manufacturer founded in 1959, and it currently produces Renault cars for the region in Tangier.

Renault’s Tangier car factory, the biggest in North Africa, required an initial investment of $785 million.

Morocco’s minister of industry, Moulay Hafid Elalamy, said earlier this year that he expects the country to be producing one million vehicles – with 80% of components locally produced – by 2020. Today, it provides 650,000 units, according to Autocar, a news website.

The Renault-Nissan Tangier facility, in Morocco, has an annual capacity of 340,000 vehicles, running six days a week with a staff of 8,000 people.

It builds four Dacia models: the Logan MCV, Lodgy, Sandero and Dokker.

Follow AMEinfo on Facebook , LinkedIn, and Twitter , and subscribe to our newsletter at the bottom of this page.