Gulf News

Babu Das Augustine, Banking Editor

Gulf countries attracted $4.57b investments across 64 transactions.

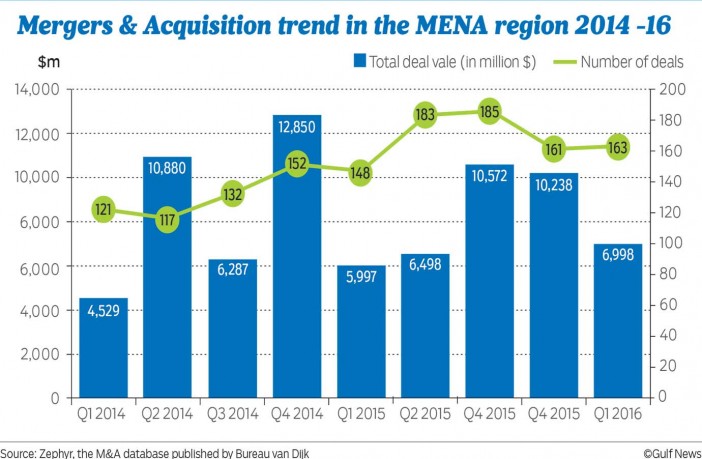

Dubai: Mergers and Acquisition (M&A) value across the Middle East and North Africa (Mena) region improved to $6.99 billion (Dh25.7 billion) in the first quarter of 2016 compared to $5.99 billion in the first quarters 2015 and $4.52 billion in the first quarter of 2014 according to Zephyr, the M&A database published by Bureau van Dijk.

Data showed that on a quarter on quarter basis the deal value declined in the first quarter of this year from $10.23 billion from 161 deals in the final quarter of 2015

The first three months of 2016, volume of 163 deals compares well with 121 deals in first quarter of 2014 and 148 deals in the first quarter of 2015.

“Taking this into account, the decline in value from the final quarter of 2015 can be seen less as a sign of things to come and more as a symptom of the traditionally quiet start to the year,” the Zephyr report said.

The relatively disappointing value can be blamed on a lack of high value deals; only two transactions broke the $1 billion barrier between January and the end of March.

GCC countries had a significant contribution to regional M&A deal flows with Kuwait leading the rankings in terms of deal values totalling $2.61 billion. The UAE, Qatar and Saudi Arabia also placed highly, coming third, fourth and sixth with $640 million, $558 million and $460 million, respectively. Oman and Bahrain placed ninth and eleventh overall in terms of value.

The top transaction in the region worth $2.02 billion was an 11 per cent stake sale in Kuwait-headquartered Al Safat Energy Holding Company by Danah Al Safat Foodstuff Company. This transaction alone represented 30 per cent of the total deal making for the first three months of the year.

In all, 65 per cent of total Mena deal making for the first quarter of 2016 was attributable to GCC countries, while 14 of the quarter’s top 25 deals featured targets in the six countries, including the top deal. The GCC region attracted combined investment of $4.57 billion across 64 transactions, of which 23 had UAE targets while Saudi Arabia and Kuwait had 15 each, Oman had seven and Qatar and Bahrain had two each.

Outside the GCC, Morocco reported the highest transaction value across the Mena region. In the overall deal making ranking Morocco came second with $1.03 billion. This figure was largely attributable to the $1.02 billion acquisition of Moroccan cement manufacturer Holcim Maroc by Lafarge Cements which was announced in March.

Although the trend for remainder of 2016 is an unknown, the deal pipeline include pending transactions such as Samsung Engineering and Samsung India increasing their stakes in Samsung Saudi Arabia in a $447 million transaction which is scheduled to close by the end of the year. Deals scheduled to close during the second quarter of 2016 include a $310 million purchase of a 40 per cent stake in Lebanon-headquartered commercial bank Credit Libanais by a consortium of undisclosed investors and Greenfields Petroleum International Company buying the balance of oil and gas explorer Bahar Energy for $64 million.