By Ian Lyall

Casablanca and the tourist traps of Marrakech are probably the first things that spring to mind when you think of Morocco. Oil definitely is not.

But fighting through the hordes of holidaymakers that throng the airports of Agadir, Rabat and Tangier are new visitors to the country – geologists, engineers and company executives.

They are part of the transformation of Morocco, which has become a magnet for some of the world’s most savvy oil explorers.

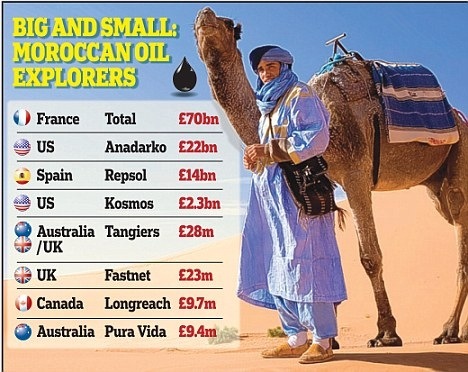

Big and small companies: Oil explorers in Morocco

The country is chronically under-explored, although that is changing with the latest influx of oil companies.

The unrest that has swept the rest of North Africa has singularly failed to threaten Morocco, which is a parliamentary constitutional monarchy, while the tax regime there for oil and gas producers is amongst the most attractive anywhere in the world.

The state receives 25 per cent of any project and a 5 per cent royalty if gas is produced, which rises to 10 per cent for oil.

An unprecedented ten-year corporate tax holiday is offered for any discovery. This means the government take is never more than 35 per cent.

Contrast this with neighbouring Algeria where the authorities take 92 per cent and you can see why foreign investment is flooding into Morocco.

Morocco has registered on the radar screen of ambitious national oil companies Total and Repsol, as well as Anadarko and Kosmos, two of the larger and more successful exploration groups. London-quoted Tangiers Petroleum and Fastnet Oil & Gas are targeting the country’s offshore oil and gas bounty.

Fastnet is the team behind Cove Energy’s huge successes in Tanzania, so has a track record of breaking new ground. Two other tiddlers with huge potential acreage are Australia’s Pura Vida and Canada’s Longreach Oil & Gas – both have a significant following here in London.

What excites investors about these smaller stocks is the potentially explosive nature of investment.

AIM and ASX-listed Tangiers believes the Atlantic waters off Morocco could harbour a rich bounty.

It estimates the recoverable resource from its concession on the Tarfaya block could be anywhere from 156million barrels to an eye-popping 5billion barrels of oil.

Pura Vida’s Mazagan permit area, meanwhile, could contain 3.2billion barrels.

It bought Mazagan for $3.5million last October, and in doing so acquired some of the last remaining open acreage. This was quite a coup.

Damon Neaves, Pura Vida managing director, said: ‘Morocco needs to develop its oil industry, particularly its deepwater potential. To do this they need to attract the big companies into the country.

‘They saw us as having the technology and expertise to do this, the modern seismic reprocessing techniques in particular.’

He added: ‘They saw us as a conduit to bringing in the big, deepwater operators to make the big investments required to pursue deepwater drilling.’

The interest of Total and Repsol suggests Morocco is now being taken seriously as a new oil frontier. City analysts agree.

Kosmos’ presence is hugely significant too, they point out.

As the discoverer of the giant Jubilee field off the coast of Ghana, it has been targeting new areas where it expects to find similar geology.

These oil-rich zones were formed millions of years ago before the world’s continents are believed to have separated.

But even the most enthusiastic advocate of Morocco as a new oil address will concede there are still huge challenges to be overcome.

The obstacles are particularly tricky for the smaller participants that have to find the funds to exploit their large acreage positions.

In some cases this will require finding a partner with deep pockets to share the huge financial burden (the cost of just one offshore well might be in the order of £16million).

Add to that the usual risks associated with exploration (the chances of finding oil can range from one in five to one in ten) and you can see why investors remain circumspect about the prospects of the smaller companies whose futures hinge purely on Moroccan success.

VERDICT: Bear this in mind if you are tempted to dip your toe in the water.