Frontera News

Investment Frontier

Morocco’s main stock exchange, the Casablanca Stock Exchange (CSE), has seen renewed activity in 2016. It had its largest IPO since 2008 with its July listing of Marsa Maroc, a state-owned port operator. This was also the first privatization of a government asset on the exchange, which could be a source of IPOs in the future.

Morocco has a GDP per capita (PPP) of around $8000 and a population of around 34 million that skews young – around 43% of the country is under the age of 25. As a result, mobile technology and internet usage in Morocco is among the highest in Africa, and there is a lot of potential for the country to be a leader in Africa and the Middle East in this space going forward. However, GDP growth has been hovering just over 4%.

Morocco is known as a first-rate tourist destination in Northern Africa, and is often cited as a potential hub country linking Europe with Africa and the Middle East. With the Western Sahara desert to its south and the Atlantic Ocean across most of its north and west border, it shares a land border with mainly Algeria, although Spain is across the Strait of Gibraltar in the north. While Arabic and Berber are the two official languages, French is prevalent as well, especially in a business setting.

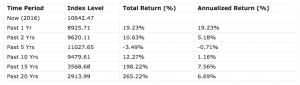

The Moroccan stock market experienced a boom period from 2002 until the financial crisis of 2008 – in the 6 years from March 2002 to its all-time high in March 2008, the market gained 331% or about 27.5% annually. Its performance has been less stellar since the crisis, and here is the table of returns for the MASI Free Float Index:

Economy

Morocco’s largest trading partners are all in Europe, with Spain, France, Italy, and Germany leading the way. Despite its reputation as a conduit to Africa, very few of its exports or imports come from the African continent. Instead, almost two thirds of its exports and imports are from Europe.

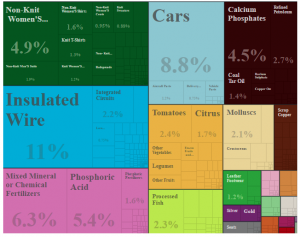

As of 2014 it had an Economic Complexity Index (ECI) of -0.569; we consider any economy with an ECI of under zero to be an indicator of its frontier market status. Morocco has the largest reserves of phosphates in the world, but a breakdown of its exports can be seen below. While Morocco is still running a trade deficit, this has reduced sharply over the past few years with both the car and phosphate export sector growing.

Tourism is a significant contributor to the economy, and is estimated to provide just under a fifth of Morocco’s GDP. Another factor to Morocco’s GDP is remittances from the diaspora, which is estimated to account for around 8% of the economy.

Morocco’s credit rating is on the cusp of being investment grade with a BBB- rating from S&P and a Ba1 rating from Moody’s, both with stable outlook.

Notable Companies in Morocco:

State-owned enterprises are among the largest companies in Morocco. A significant number of large Moroccan companies are also subsidiaries of the Société Nationale d’Investissement (SNI, National Investment Company), which is a holding company owned by the royal family. While many of them are not listed on the stock exchange yet, the recent listing of Marsa Maroc this year gives hope for further listings down the road:

- Office Chérifien des Phosphates (OCP) (Not-listed, although there are bonds): 100% owned by the government of Morocco, OCP is the world’s largest producer of phosphates and a major global fertilizer company

- l’Office National de l’Eau et de l’Électricité (l’ONEE) (Not-listed): the National Office of Water and Electricity is government owned, but is also one of the largest companies by revenue in Morocco

- Maroc Telecom (aka Itissalat Al-Maghrib or IAM) (Listed on Euronext and CSE): Morocco’s largest telecommunications company, and one of the largest privately owned companies in the country

- Attijariwafa Bank (Listed): Morocco’s largest bank by revenues, largest shareholder is the SNI

Banque Central Populaire (BCP)(Listed): Morocco’s second largest bank - Wafa Assurance (Listed): Leading insurance brand in Morocco, majority owned by Attijariwafa Bank

- Marjane (Not-listed): Morocco’s largest supermarket chain, owned by SNI

- Addoha Group (aka Douja Prom Addoha) (Listed): leading real estate company in Morocco

Is It Safe To Invest In Morocco?

According to our Investment Safety Rankings, Morocco is ranked #86 in the world so is in the middle of the pack globally, but relatively safe when compared to most other frontier markets. Corruption is a concern in the country, but for investors investing on the CSE, these fears are much reduced with recent reforms.

Can Foreigners Invest In Morocco?

Yes. About a third of the shares on the CSE are owned by foreigners, and foreigners made up just under 15% of the volumes on the CSE over the past two years. Investors from the UAE and France are the main sources of foreign investment on the CSE.

Casablanca Stock Exchange (CSE) Snapshot:

In operation since: 1929, but reformed in 1993

Location: Casablanca, Morocco

Market hours: 09:30 to 15:30

Currency: Moroccan dirham (MAD)

Market Capitalization (as of Nov 2016): 535 billion MAD (about $53 billion USD) for the entire market

Local Listed companies (as of Nov 2016): 75 total companies on the stock exchange: 47 on the main market, 16 on the development market, and 12 on the growth market. Note that this is about to be 74 companies since Oil & Gas company SAMIR is facing bankruptcy. There are also 42 corporate bonds, 5 debenture loans, and 20 rights offerings on the exchange.

Exchange Fees: For the exchange: 0.1% of the amount of trading in shares. The commisions on bonds are of 0.005% capped at 5000 MAD per side of the transaction. Brokerage fees are on top of this. Fees are also subject to VAT of 10%

Taxes: Capital gains are taxed at 20%, dividends are subject to a withholding tax of 15%

Foreign currency controls: Generally no restrictions

Main Index: MASI (Moroccan All Shares Index) Free Float Index, contains every share listed on the exchange but weighted by free-float capitalization.

How the Casablanca Stock Exchange is Structured:

The CSE is joint-owned by local brokerage, bank, insurance, and other large financial companies in Morocco.

The equity market is split into three markets: the Main Market, Development Market, and Growth Market in order of company size. They have varying standards when it comes to certified financial periods and financial statements.

In contrast, there is only one bond market that require a minimum of 20 million MAD notionals for listing.

Local Companies Listed on the Casablanca Stock Exchange:

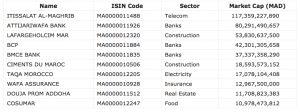

Here are the top 10 companies by market cap on the Casablanca Stock Exchange (as of Nov 2016):

How to Invest on the Casablanca Stock Exchange:

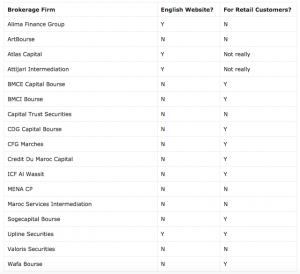

To trade on the Casablanca Stock Exchange, you need to trade through an authorized Moroccan brokerage firm. There are currently 17 different brokerage firms to choose from.

Step #1: Find a brokerage firm

Trading on the Casablanca exchange requires opening an account with an intermediary, mainly in the form of brokerage firms.

There are currently 17 brokerage firms listed on the official Casablanca SE website, which can be found here.

Unless you understand French, you will want to find one of the brokerages that have an English website. You’ll also want to find one that is focused more on retail customers rather than institutional clients. For example, Attijari Intermediation has the highest market share/biggest volumes executed on the exchange, but are focused on institutional clients, so unless you are a High Wealth Individual (and willing to put in enough to qualify you for that distinction in Morocco), they are probably not the right broker.

We’ve gone through all the brokers for you, and with the help of Google Translate have a handy table here:

The tricky part is that most firms that help retail customers only have French websites, while the firms with English websites are mostly for institutional clients. Another issue is that many of the firms that cater to retail clients are just big banks which happen to offer brokerage services, but may require you to have an existing bank account with them.

In the end, we found 4 brokerage firms that catered to retail clients and mentioned account opening processes for non-resident foreigners. They were:

- BMCE Capital Bourse

- CDG Capital Bourse

- Upline Securities

- Wafa Bourse

Upline Securities is the only one with an English website, but for online-trading they actually refer you to ICF Al Wassit, which turns out to be a subsidiary of theirs. That site is entirely in French. At least Google Translate seems to be getting better..

Step #2: Fill out application forms and send required documents

From checking out the account opening processes with those 4 brokers, the application process seems to be quite straight forward. For non-resident foreigners, you will need the following documents:

- Application form

- Passport

- Voided check from your bank account

- Address proof (usually a utility bill)