The Lincolnian online

Posted by Alanna Baker

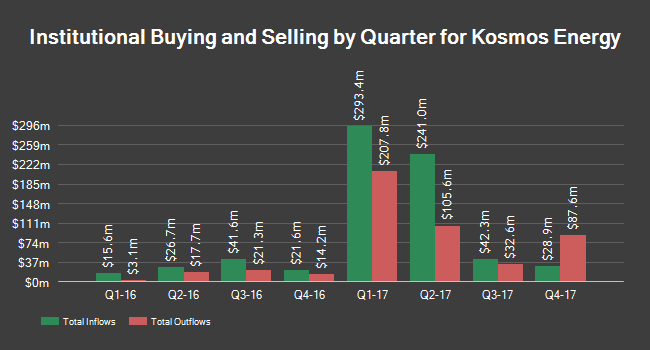

Goldman Sachs Group Inc. grew its stake in Kosmos Energy Ltd (NYSE:KOS) by 3.6% in the 4th quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm owned 1,806,073 shares of the oil and gas producer’s stock after buying an additional 63,272 shares during the quarter. Goldman Sachs Group Inc. owned 0.46% of Kosmos Energy worth $12,372,000 as of its most recent SEC filing.

Several other hedge funds also recently modified their holdings of KOS. Prudential Financial Inc. acquired a new position in shares of Kosmos Energy in the 3rd quarter valued at about $1,531,000. New York State Common Retirement Fund lifted its holdings in shares of Kosmos Energy by 28.9% in the 3rd quarter. New York State Common Retirement Fund now owns 626,300 shares of the oil and gas producer’s stock valued at $4,985,000 after buying an additional 140,500 shares during the period.

Rhumbline Advisers lifted its holdings in shares of Kosmos Energy by 7.2% in the 3rd quarter. Rhumbline Advisers now owns 175,115 shares of the oil and gas producer’s stock valued at $1,394,000 after buying an additional 11,717 shares during the period. Bank of New York Mellon Corp lifted its holdings in shares of Kosmos Energy by 15.0% in the 3rd quarter.

Bank of New York Mellon Corp now owns 1,035,850 shares of the oil and gas producer’s stock valued at $8,246,000 after buying an additional 135,119 shares during the period. Finally, Macquarie Group Ltd. acquired a new position in shares of Kosmos Energy in the 3rd quarter valued at about $214,000. 98.80% of the stock is owned by institutional investors and hedge funds.

NYSE:KOS opened at $6.67 on Friday. Kosmos Energy Ltd has a 12 month low of $5.15 and a 12 month high of $8.62. The company has a quick ratio of 1.08, a current ratio of 1.24 and a debt-to-equity ratio of 1.43. The company has a market cap of $2,560.22, a price-to-earnings ratio of -20.21 and a beta of 1.53.

Kosmos Energy (NYSE:KOS) last posted its quarterly earnings data on Monday, February 26th. The oil and gas producer reported ($0.10) EPS for the quarter, topping the Thomson Reuters’ consensus estimate of ($0.11) by $0.01. Kosmos Energy had a negative return on equity of 12.49% and a negative net margin of 34.98%. The company had revenue of $187.10 million during the quarter, compared to analyst estimates of $182.28 million. During the same period in the previous year, the business earned ($0.01) EPS. Kosmos Energy’s quarterly revenue was down 11.3% on a year-over-year basis. equities research analysts forecast that Kosmos Energy Ltd will post -0.13 earnings per share for the current year.

Several equities analysts have recently issued reports on KOS shares. Jefferies Group set a $6.00 price objective on Kosmos Energy and gave the company a “hold” rating in a report on Friday, February 9th. BMO Capital Markets set a $10.00 price target on Kosmos Energy and gave the stock a “buy” rating in a report on Monday, February 26th. Bank of America raised Kosmos Energy from a “neutral” rating to a “buy” rating in a report on Wednesday, January 24th.

ValuEngine raised Kosmos Energy from a “sell” rating to a “hold” rating in a report on Friday. Finally, Credit Suisse Group raised Kosmos Energy from a “neutral” rating to an “outperform” rating in a report on Monday, January 8th. Two research analysts have rated the stock with a sell rating, five have assigned a hold rating and ten have given a buy rating to the stock. The stock presently has a consensus rating of “Hold” and a consensus price target of $9.36.

Kosmos Energy Company Profile

Kosmos Energy Ltd. (Kosmos) is an independent oil and gas exploration and production company. The Company is focused on the emerging areas along the Atlantic Margins. Its assets include existing production and development projects offshore Ghana, discoveries and further exploration potential offshore Mauritania and Senegal, as well as exploration licenses with hydrocarbon potential offshore Sao Tome and Principe, Suriname, Morocco and Western Sahara.