Undercurrent News

Matilde Mereghetti

Moroccan octopus prices remain at record high, amid a combination of short supply from several large producing countries and increasing popularity of the species boosting demand, sources from a number of firms dealing with the product told Undercurrent News.

In June, producers and buyers hoped that the end of Ramadan would cause a decline in octopus prices in Morocco, which had reached a record high both in the country and its neighbors.

However, strong demand and lower catches — both in Morocco and neighboring countries as well as in Mexico — caused global prices to continue to rise, according to sources.

“Buyers are scared, as prices at the origin are more expensive than sale [prices],” a source at a large Moroccan buyer told Undercurrentlast month. He also added that there was also scarcity of sepia (cuttlefish), as prices from India were “exaggerated”.

“Surely, the price is so high due to the poor amount of octopus. Even in Mexico fishing was microscopic,” another source noted.

The latest season in Morocco saw catches mainly in the medium T6, T7 and T8 size brackets. Prices offered by customers in Spain for the frozen onboard octopus on Sept. 14 were €10,100 per-metric-ton for size T5, €11,000/t for T4, €12,200/t for T3, €13,200/t for T2 and €14,200/t for T1, according to sources.

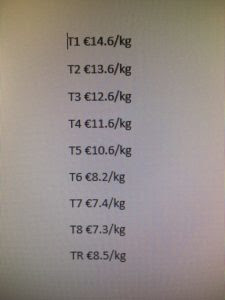

Octopus prices in Morocco provided by a Moroccan supplier on Oct. 24, 2017

Prices have since remained at a similar high level since, one source confirmed this week. He also provided a new set of prices (see table on the left).

Moroccan stocks were “quickly liquidated” and sold out immediately, a few days after the end of the season. The next season is still over a month away, sources noted.

Normally the winter season in Morocco starts at the beginning of December and the exact opening date should be announced by the country’s authorities in mid-November.

“US buyers usually buy very large octopus (T2, T3, T4) or very small (T8, T9). Unfortunately, this year, we were forced to ship only small octopus due to lack of availability of large pieces,” one source at a Moroccan firm said, who also noted that Japanese buyers bought mainly T6, T7, T8 at market prices, preferring frozen on board or inland processed product from factories where their own inspectors are present.

A rise in octopus prices has squeezed large margins of octopus traders and processors, which have tried to diversify supply as much as possible.

A large Portuguese processor, Brasmar, for example, said it diversified its suppliers.

Brasmar, which is owned 50% by MCH Private Equity, has diversified its range of products in order to “become one stop shop for its clients” as it plans acquisitions to expand its customer base, the firm’s CEO, Sergio Silva, told Undercurrent.

The firm has diversified its portfolio to over 1,000 SKUs and its base of suppliers to over 1,000, “not to depend on any specific market or supplier”.

Portugal, northern Spain

Octopus landings in Galicia, northern Spain, fell 47% from the start of the fishing season on July 3 to Sept. 30, with 436.6t auctioned, which caused a 37% rise in prices, La Opinion Coruna reported.

Meanwhile, Portuguese fishing associations and organizations met last week in Lisbon to discuss the species’s scarcity, which has been especially felt this year, CM Jornalreported.

They defended a stop in fishing of more than one month to recover the stocks.

“Today, I go to the sea and I get 10 or 20 kilograms of octopus, when in other years it was more than 100kg. The situation is getting complicated because it no longer justifies the expenses we have with the boats and the labor,” said Jose Agostinho, president of the Armalgarve octopus fishing association.

For now, they asked for a stop in fishing of 40 days to allow octopus to grow in size, but have not yet received a response from the Portuguese government. “We have to act with urgency. We are heading for a total collapse,” Agostinho told to CM Jornal.

Venezuela firms seeing strong demand for short octopus

Representatives of Venezuelan firms on their first joint stand at the Conxemar seafood show earlier this month told Undercurrent that demand for their octopus production is increasing, because of the global scarcity of the species.

Octopus prices have spiked in recent months, while production in Mexico has dropped, sources said.

The Venezuelan octopus season runs between July and December and catches are good, Leonardo Paex, general director at seafood firm Piedras Corporation, told Undercurrent.

Venezuelan firms are therefore able to offer competitive prices. For example, octopus of 800-1,200 grams could cost €6.5-€8/kg.

Piedras, a holding of eight firms and fifteen associated companies producing different times of fish and seafood sells octopus, farmed shrimps, red fish blue crab and lobster, among other products.

“The country’s difficulties force us to be more aggressive and creative,” Paex told Undercurrent. Piedras is associated to Venezuela’s largest shrimp producer, Lamar Group, which processes 20,000 metric tons per year.

Octopus robberies on the rise in Mexico

Meanwhile, organized crime has hit the Yucatan fishing industry and put the sector in “red alert”, following the robbery of octopus cargos worth over $2 million over the last month, the Yucatan Times reported.

In the last 30 days thieves have stolen 13 trailers with octopus cargo that from Progreso and Yucalpeten were directed to Mexico City, Guadalajara and Guanajuato, among other cities of the region.

Shipments of octopus cargo were stopped temporarily, but will soon be resumed in the custody of federal authorities, being carried out in convoys protected by the Mexican navy and the Mexican army.

There is a lot of interest from Europe in acquiring large quantities of this product, with buyers sent to Yucatan looking for octopus. So far this year, there were already sent to Europe 2,000t of octopus, according to the Yucatan Times.

PAKISTAN, INDIA

Octopus in Pakistan and India prices have “gone up hence it seems that there is a big demand”, a processor based in Pakistan told Undercurrent.

“The trouble, however, still exists as the landing of octopus is very, very limited,” he added.

Prices had risen earlier this year, exporters had told Undercurrent.

China is the largest market for octopus from India and Pakistan, according to the first source. Chinese firms re-process it and sell it to other markets, including Europe, the firm said.

Contact the author matilde.mereghetti@undercurrentnews.com