Bloomberg

by Srinivasan Sivabalan

If you’re an equity investor, ignore frontier markets at your peril.

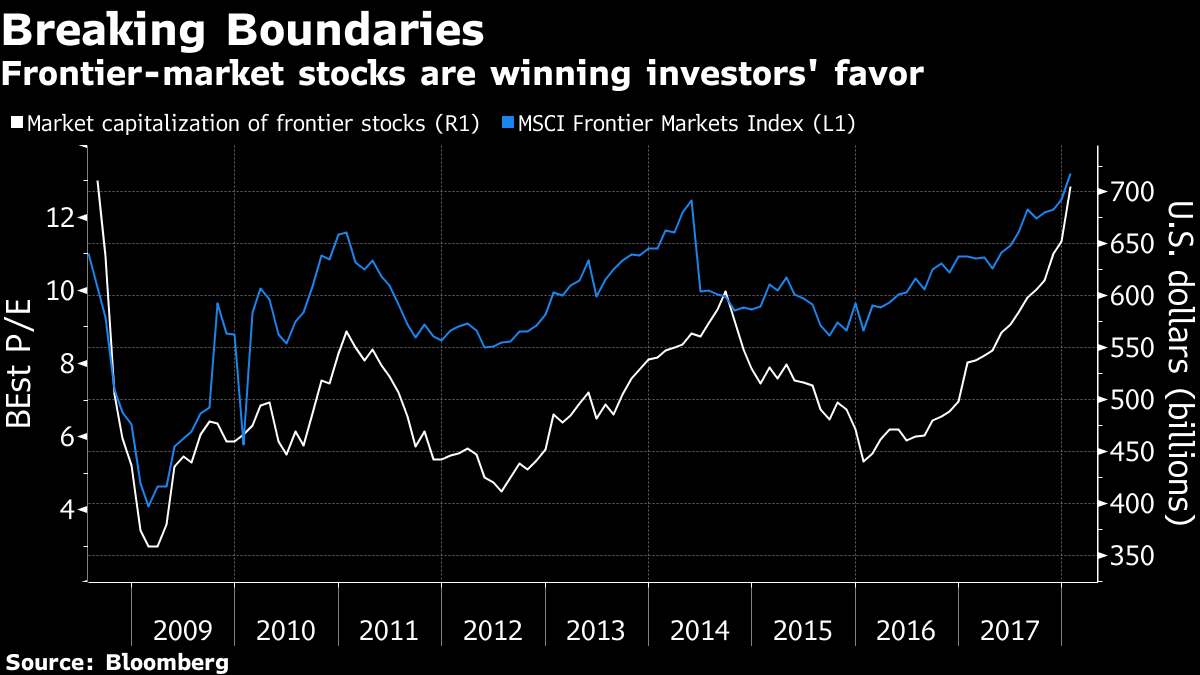

Some of the key themes of 2018 are unfolding in nations such as Argentina, Kuwait and Nigeria, even as their big-brother emerging markets capture much of the attention. With the combined market value exceeding $700 billion for the first time in a decade, the frontier group has begun to outpace emerging-market stocks after three years of underperformance.

That’s because a wave of reforms is sweeping across smaller developing economies, be it Argentina’s overhaul of its inefficient tax system, Vietnam’s privatization drive or currency liberalization from Nigeria to Morocco. The changes are encouraging investors to pay a higher price to own those countries’ stocks — what jargon lovers call “re-rating.”

“People are returning to frontier markets quite enthusiastically,” says Tony Hann, the head of equities at Blackfriars Asset Management Ltd. in London. “Strengthening oil prices may be one broad theme, but otherwise, there are specific elements like currency reforms that are driving specific markets.”

The MSCI Frontier Markets Index trades at 13.2 times the 12-month estimated profits of its member companies, the richest valuation on record, data compiled by Bloomberg show. It’s also the priciest level since June 2014 compared with emerging-market equities. The frontier gauge is on course for an 11th successive month of gains, a record streak.

Star of the Show

Unlike Pakistan, which became a small fish in a big pond last year with its promotion to emerging market by MSCI Inc., Argentina’s failure to get the upgrade has worked in its favor. The $125 billion market accounts for 23 percent of the frontier-markets gauge, the biggest weight.

- The benchmark Merval Index has jumped 56 percent since the MSCI rejection in June as the government makes policy tweaks to support growth and investment. Regulators have approved short-selling of stocks, a move that may improve Argentina’s chances of getting that elusive MSCI upgrade

- The Congress has approved a plan to reduce corporate taxes by 10 percentage points over a decade, which combined with sales-tax concessions, may reduce the tax burden by 4 percent of gross domestic product. The central bank raised its inflation target to support the economic recovery as loan growth is seen accelerating to 42 percent this year.

Improving Financials

- Credit growth and bank profits are becoming a recurring theme in frontier markets. In Kuwait, bank stocks are heading for the biggest monthly gain in a year as investors wager they’re the best-placed among regional peers to benefit from global interest-rate normalization. In Nigeria, the world’s best-performing stock market this year, tier 2 lenders are seen as the most attractive opportunity.

- From Morocco to Nigeria, policy makers are allowing pegged currencies to move more freely. This follows a shift by Kazakhstan, Argentina and Egypt in the last couple of years that has eased the risk investors will struggle to repatriate profits.

New Asian Tigers

- Vietnam has been an indirect beneficiary of Pakistan’s struggle to attract investors after the MSCI graduation. The nation has a 13.7 percent weight in the frontier-market index, the third-largest presence. The Vietnam Stock Index has rallied for six consecutive years, capping a 48 percent jump in 2017. It’s already up 6.7 percent in January.

- Even though there are murmurs the gains have gone too far, Hann says the country remains well placed to benefit from one of the world’s fastest growth rates. The economy is projected to expand 6.6 percent this year and 6.7 percent in 2019.

- Sri Lanka is worming its way into investor consciousness, almost a decade after it emerged from a civil war. The country’s tourism potential and its appeal as a transshipment location will offer opportunities in the coming years, Hann said.