In the coming weeks Genel Energy and its co-investors will reveal whether an exploration well being drilled at the Nour prospect in the Atlantic waters off Morocco has struck oil or not.

The project – a key test of the region’s prospects – is part of an attempt by the FTSE 250 company to develop a business beyond its focus on building oil and gas exports from the troubled Kurdistan region of Iraq.

It also forms part of a billion-dollar bet on exploration spending off the North African country.

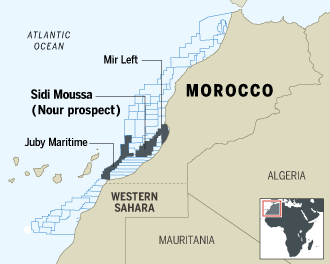

Genel, led by Tony Hayward, the former chief executive of BP, holds a 60 per cent stake in the Sidi Moussa block. Exploration juniors Serica, San Leon Energy and Longreach, hold a combined 15 per cent, and Moroccan state oil company ONHYM owns the remaining quarter stake in the licence.

Investors in the exploration well, one of a dozen being drilled in the latest of three waves of exploration off Morocco in recent decades, are targeting prospective resources of 300m barrels of oil – though the well’s chances of a commercial find have been put at just one in five.

Mr Hayward says he remains hopeful over the region’s prospects, while conceding that success for Genel and its peers in Morocco’s waters is not a forgone conclusion.

“By this time next year we will know whether Morocco is a hydrocarbon province or not,” he says. “There’s 10 to 12 well results being drilled over the past year into next. It will determine whether it’s a new frontier or not. At the moment the jury is out.”

Morocco’s offshore blocks are not virgin drilling territories.

Stephane Foucaud, an analyst at FirstEnergy, says the same acreage now under licence came under attention at the beginning of the 2000s.

Then, as now, there was excitement that improved technologies and better understanding of geologies could unlock oil and gas in seas unsuccessfully explored in the late 1960s and 1970s. However, after two years of dry holes being drilled in that last exploration wave, many licences were quietly relinquished.

Mr Foucaud estimates $350m-$400m has been pumped into the latest round of exploration drilling off Morocco’s coast. That total should exceed $1bn by the end of next year, he estimates.

So far the results have been disappointing. A month ago Portugal’s Galp confirmed it had drilled a dry well targeting two objectives on its Tarfaya offshore block where it had invested with ONHYM and Aim-quoted partner Tangiers Petroleum. Shares in Tangiers, whose quarter stake in the licence was viewed as a core asset, fell 28 per cent following the well’s failure.

Cairn Energy, another of the pioneers in the latest drilling, also came up dry at its Foum Draa block. This year Cairn drilled at the adjacent Cap Juby Maritime I-III licence area in which Genel also holds a 37.5 per cent stake.

Hydrocarbons were found at this prospect – consistent with an old heavy oil discovery declared by Esso in 1969. But neither exploration well was considered a commercial success.

But Cairn is continuing its campaign in the region. This year it is backing an exploration well at the Gargaa prospect on the Cap Boujdour block in Moroccan-licensed waters to the south of those already explored in the last year, with majority partner Kosmos Energy of the US.

Kosmos has already recruited BP as a partner in its near-shore licences in the Agadir basin. Drilling at Cap Boujdour off Western Sahara could prove more controversial – sovereignty of the former Spanish colony along with its waters is disputed between Morocco and the Algerian-backed Polisario Front independence movement.

Chevron has also joined the rush to take up licences in Morocco, which according to Mr Foucaud has provided an attractive fiscal environment to encourage drilling. It is a populous country heavily dependent on oil imports and with little proven hydrocarbon resources. “It is one of the better regimes in terms of the tax structure,” he says. “If there’s a discovery, it’s worth a lot.”

Exploration success over the past 10 years in other areas of the so-called Atlantic margins, such as Ghana, Brazil and eastern Canada, have encouraged a renewal of interest among companies in geological formations off west Africa.

Despite disappointment so far, hope in Morocco’s prospects persists.

Oisin Fanning, chairman of San Leon that has an 8.5 per cent stake in the Genel-operated well, has described Morocco as “one of the last under-explored regions of north Africa”.

By Michael Kavanagh