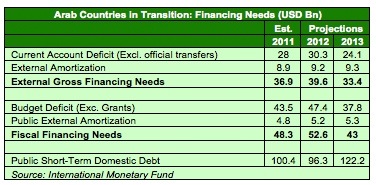

Countries hit by the promising but disruptive Arab Spring will need financing to the tune of USD43-billion next year, according to the International Monetary Fund (IMF).

But Arab Countries In Transition, or ACT, will have a hard time raising funds to get their economies back on track in the midst of political turmoil and poor private sector investment.

While political turmoil in places like Egypt, Libya, Morocco, Syria and Yemen have eased compared to what they were a year ago, Syria is still in the throes of a bloody civil war.

“With the exception of Libya, the ACTs’ growth in 2012 has remained weak in light of continued policy uncertainty, regional tensions, the deteriorating global economy, and high food and fuel commodity prices,” said IMF.

Indeed, Libya’s economic recovery has been impressive, although it does mask great political divisions and poor non-hydrocarbons’ infrastructure.

The IMF forecast the country’s real GDP to rise 116.6% in 2012 – an astonishing figure primarily because 2011 saw a 60% contraction in the economy. Oil output, which has returned to prewar levels, is primarily responsible for the stellar growth figure.

But non-hydrocarbon real GDP is estimated to reach 30%, although it fell off a cliff by 63% last year, suggesting the private sector is not firing on all cylinders.

“Libya has an opportunity to break with the past and promote inclusive growth by developing a vibrant, private-sector driven economy,” the IMF recommends.

But the recent attack on U.S. embassy which led to the death of the Christopher Stevens, the U.S. ambassador to Libya, suggests that the security situation remains fragile and there are many dangers lurking within the North African country that could derail progress.

According to a report by International Human Rights Clinic (IHRC), part of the Human Rights Program at Harvard Law School, Libya has close to USD22-billion worth of weapons accumulated over decades and much of them are now unaccounted for.

See Libya Report

Other key pillars of the Libyan political structure are still not in place.

“Most significantly, Libya’s interim authorities do not have a monopoly on the use of force as militias not loyal to the Libyan state remain important actors in localised conflicts throughout the country,” wrote Torbjorn Soltvedt, senior analyst at risk management consultancy Maplecroft in a note to clients.

“Furthermore, with the constitution still to be written, the relationship between Libya’s regions and the central government has not been determined.”

Mr. Soltvedt says the uncertain political situation in Libya and enduring security concerns remains a significant deterrent to foreign investment, although Big Oil will continue to remain interested in the country.

“Investor confidence is unlikely to improve significantly until greater progress has been made towards establishing a legitimate and strong central authority capable of addressing the county’s security concerns.

EGYPT’S FISCAL CHALLENGE

Next door neighbour Egypt does not enjoy the hydrocarbon riches to heal its fiscal pain.

While the country has managed to preserve macroeconomic stability, a broad recovery is unlikely unless the country’s political and policy issues are resolved.

Real GDP growth rose by a paltry 1.8% in 2011 and forecast to grow 2% this year, a far cry from the galloping 5.1% it registered a year before the Arab Spring swept into the country.

“The balance of payments also deteriorated owing to portfolio capital outflows and lower tourism revenues and FDI [foreign direct investment],” said the IMF.

“As a result, international reserves (including the central bank’s foreign currency deposits in domestic banks) declined to USD15.1-billion at end-August, from USD43-billion at end-December 2010, notwithstanding some bilateral support and the issuance of foreign currency T-bills.”

Public debt as a percentage of GDP has risen from 73% in 2009 to nearly 80% this year, while reserves in months of imports have shrunk from nearly 7 months two years ago to 2.7 months.

While the global economic crisis has not helped an Egyptian recovery, the country also has domestic issues to contend with.

Most crucial is containing the fiscal and balance of payment deficits.

The IMF recommends reducing ‘inefficient energy subsidies’ – which accounts for 6% of GDP -, reforming tax policies and investing in infrastructure, education and health to improve standards of living and stimulate job creation.

EFG-Hermes believes cutting subsidies is unlikely to happen for some time to come, given the political sensitivity surrounding the issue.

“The nature of the subsidy reforms, which require large administrative and logistical efforts, is likely to prove a major challenge, making it nearly impossible at this stage to envisage potential savings in the coming two years,” said Mohamed Abu Basha.

However, the IMF says such tough decisions will be necessary to ensure Egypt’s economy rights itself.

“Creating a more transparent and competitive business environment, streamlining burdensome regulations, and improving access to financing, especially for small enterprises, should help boost economic activity and create jobs. Increasing investment in human capital and infrastructure should help provide more equal access to job and business opportunities for all sections of society.”

JORDAN’S SUBSIDIES

Another country grappling with unsustainable subsidies is Jordan.

Caught in the tsunami of events around it, Jordan has struggled to gets its economy on track and has also been held back by festering domestic troubles.

Economic growth of 2.3% and 2.6% over the past two years has not helped business confidence, although the IMF’s three-year stand-by arrangement, plus aid and loans from Gulf states and other countries should help the economy.

While the Fund expects GDP to rise to 3% this year, the external current account deficit is expected to widen to an estimated 14 percent of GDP in 2012, from 12 percent of GDP in 2011, on the back of a higher energy imports.

“The 2012 central government deficit (excluding grants) is projected to narrow by about 1 percent of GDP relative to the 2011 outturn, but the operating losses of NEPCO are higher than in 2011, resulting in a public debt-to-GDP ratio of slightly below 80 percent by end-2012.”

MOROCCO’S POOR HARVEST

Similarly, Morocco – another country that avoided the worst of the regional crisis but was still affected, will less economic growth fall from nearly 5% last year to 2.9% this year due to the Euro crisis and a poor harvest.

The IMF’s USD6.2-billion liquidity line, approved in August, should help Morocco navigate through the crisis.

Unemployment rate of 9% and a widening current account deficit remains challenging for the economy and calls for greater reform to improve labour participation and domestic growth in the economy.

“Morocco faces external risks related to a marked deterioration in economic activity in the advanced trading partners, especially in the euro area, which could have sizeable real spillovers on growth and the balance of payments, notes the IMF. “Moreover, Morocco is vulnerable to a spike in international oil and food prices.”

TUNISIA: ZERO GROWTH IN GROUND ZERO

Meanwhile, Tunisia – ground zero of the Arab Spring has to contend with zero GDP growth last year, amid political tensions and an uncertain global economic environment.

Market observers forecast a worsening situation in the country, especially if the European Union, its largest trading partner, falls further into a recession.

“In light of a difficult international environment, a better-targeted countercyclical fiscal expansion, relying more on a pick-up in public investment, could support short-term growth and job creation,” said the IMF. “Monetary policy should address inflationary pressures and more exchange rate flexibility (recent steps towards this have been initiated by the central bank) would help to stabilize official foreign reserves.”

Finally, Yemen – the poorest Arab state, saw the economy contract 10.5% last year, and is set to fall a further 1.9% this year, according to estimates.

For the economy to recover oil production will have to recover dramatically, but is unlikely.

Yemen oil supply is expected to drop 40,000 barrels per day in 2012 to average 180,000 bpd, according to OPEC. “The risk and uncertainties of the forecast remain on the high side giving the continued security issues, as well as data availability.”

CONCLUSION

The IMF expects a moderate recovery in the ACT countries next year, although there are headwinds coming from all sides – a poor global economic environment, regional crisis, domestic tensions and ideological confrontations between the secular and Islamists stakeholders in many affected states.

“The shrinking of fiscal and reserve buffers over the past year has left very little policy space and heightened vulnerabilities.”

Nonetheless, the IMF believes growth will not be sufficient to tackle the region’s high rates of unemployment, especially among women and youth.

“Fiscal balances are expected to improve, as the diminished buffers leave policymakers with few choices than to adjust, and as the economic recovery increasingly supports fiscal revenues.”

Another major question mark is the Syrian and Iranian crisis which could engulf other regional states as well.

While most ACT economies have implemented reforms, they have been patchy and have often been trumped by political considerations and the inability of insecure politicians to take tough decisions.

.