AIN Online

Aerospace News: Aviation International News

by Peter Shaw-Smith

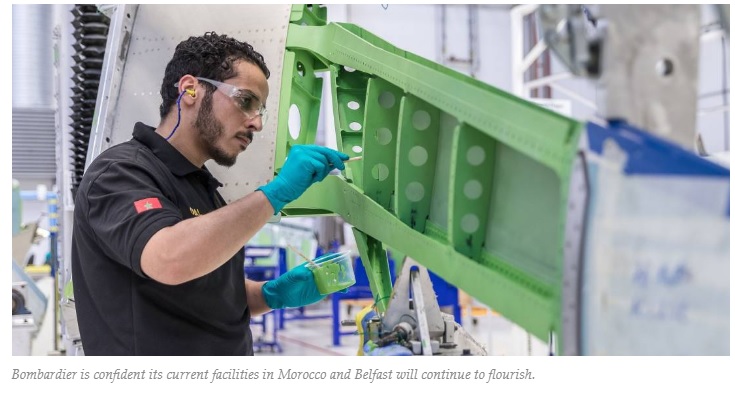

The situation regarding the sale of the Bombardier facility in Morocco, which has been tied to the fate of another Bombardier facility based in Belfast, Northern Ireland, was clarified to AIN by a Bombardier official June 1 in the run-up to the Paris Air Show.

Although a sale to a third party appears inevitable, the intention seems to be that Morocco and Belfast will remain a key link in the OEM’s supply chain.

“Bombardier decided to focus investment on its business jet activities and trains,” a Casablanca-based Bombardier Aviation spokeswoman told AIN. “Following a strategic review of its aerostructures and engineering services business segment, it intends to sell its Belfast and Morocco sites based on the strong offering we have in our operations.

“The Morocco site plays, and will continue to play, an important role in Bombardier’s supply chain. It is a world-class aerostructures facility with an extremely competitive cost. It has grown the business to a workforce of around 400 highly skilled employees. We are confident that the proposed sale will provide new opportunities for our operations and our future. We will maintain and grow our strategic presence in Morocco to enhance our position and develop the Moroccan aerospace ecosystem.”

Work currently being carried out in the Moroccan facility includes wing components for Bombardier’s CRJ regional aircraft, such as flaps, slats, ailerons, and winglets, as well as the complete engine nacelle; fuselage sections for the Learjet 70/75, floors for CRJs and Globals, Challenger 650 emergency doors and some subassemblies for different programs, in addition to the MRO activities. Several facilities are located in Belfast, including engineering, fuselage and wing production, and MRO.

“In addition to Bombardier programs, we have signed a contract with Airbus for the A320neo thrust reverser,” she said. “Development is ongoing in Belfast. Design and fabrication will be undertaken in Belfast, but the assembly will be done in Casablanca. This represents a major long-term contract on a high-volume platform. We are recognized as a global leader in aerostructures, with unique end-to-end capabilities through design and development, testing and manufacture, to after-market support.

“Following the announcement of Bombardier to divest its aerostructures activity in Belfast and Morocco, I continue to be confident in the future of the site in Casablanca,” Stephen Orr, senior executive v-p and general manager of the Morocco manufacturing center, told AIN. “Our growth and development have been steady and future contracts that are already in place ensure that this site will continue on its journey to world-class status as an aerostructures provider in conjunction with the Belfast facility.”

Impressive Statistics

Morocco’s aerospace industry can point to impressive statistics. From 2014 to 2018, sales increased 33 percent to $1.2 billion, the workforce grew 55 percent to 15,500, the number of companies grew 30 percent to 130, and the percentage of local integration into the global supply chain grew from 17 to 29 percent. “Morocco…is ranked number five among the most attractive countries for suppliers [worldwide] and number one in Africa,” Ali Seddiki, director of aerospace industry at the Ministry of Industry, Investment, Trade, and Digital Economy, said last year.

Addressing the topic of “Opportunities in Aerospace Industry in Morocco” at a seminar in Japan last November, he said Morocco was strategically located and was the closest African country to both Europe and the U.S. The North African nation claims monthly average labor costs of $330, compared to $2,300 in Spain. Around 75 percent of European import transit moves through the Straits of Gibraltar. Casablanca was the number-one hub between Europe and Africa, with 1,200 flights a week, he said.

Morocco’s high-value and diversified supply chain today has installed capacity in MRO, aerostructures, engineering, machining, sheet metal working, and electrical wiring.

According to the International Monetary Fund, Morocco’s nominal GDP was expected to be $129 billion in 2019, a growth rate of 4 percent. In 2016, the U.S. was Morocco’s fourth-largest export destination, in local currency terms, after Spain, France, and Italy. As a result, some 90 new companies are expected to join Morocco’s aerospace sector by 2021, with turnover expected to more than double to $2.6 billion.

Boeing Ecosystem

In only two years, Boeing claims to have reached out to more than 250 existing suppliers to further its goal, shared with the kingdom, to create an ecosystem of aerospace suppliers in Morocco, Caroline Tourrier, communications manager for France and North Africa at Boeing International Corp., told AIN.

“We are also engaged in other activities to share information about Morocco’s aerospace industry and its talented workforce, as well as government investments and incentives for Boeing suppliers to consider operations in Morocco,” she said. “Already, nine suppliers, both direct and indirect, have taken advantage of the partnership and are now in position to be very competitive in the aerospace industry with Boeing and other OEMs. Recently, two suppliers—Hutchinson and TDM Aerospace—were awarded contracts to supply directly to Boeing.”

In total, supplier engagement has progressed rapidly in support of meeting the Kingdom of Morocco’s and Boeing’s shared goal of creating 8,700 jobs and $1 billion in economic impact by 2028, she said.

“Royal Air Maroc operates a domestic network throughout Morocco and serves more than 90 destinations across Africa, the Middle East, Europe, North America, and South America, with a fleet of about 50 Boeing airplanes, including 737s, 767-300ERs, and 787s,” she said.

“RAM has taken delivery of five 787-8s, the last one in December 2016. Subsequently, they have ordered four 787-9s, as well as four 737 Max 8s, and they have converted a former 767 passenger airplane into a Boeing Converted Freighter, [delivered to] the airline…in April 2018.”