FTSE

www.ftseglobalmarkets

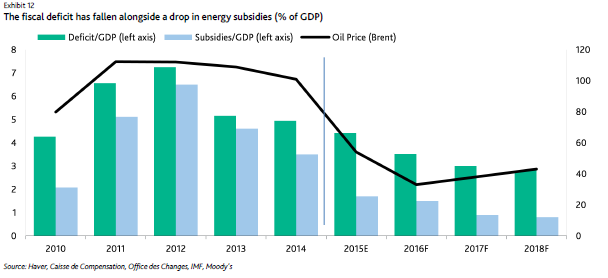

Moody’s says in its annual Credit Analysis Report for the Government of Morocco that Morocco’s (Ba1 stable) government balance sheet is set to strengthen in 2016-17 as the country benefits from lower energy spending following the drop in oil prices. “Lower oil prices have softened the impact of the government’s energy subsidy reforms.

We forecast this will lead to structural improvements in the government’s fiscal and external accounts, as well as create additional room for capital expenditures,” says Elisa Parisi-Capone, an assistant vice president — analyst at Moody’s. “We also expect foreign direct investment inflows to remain strong in the next 18 months. Morocco’s stable environment and favourable economic growth prospects make it an appealing destination for investment, particularly in services, newer export industries and alternative energy.”

Morocco’s creditworthiness, says the ratings agency, has been supported by a reduction in fiscal and external imbalances aided by lower oil prices and by its successful energy subsidy reform. Under the government’s strategy to expand its manufacturing sector and diversify its export base into higher value-added sectors, automotive exports continued to grow strongly in 2015. Foreign direct investment (FDI) inflows have sustained the economy’s structural transformation during a period where the tourism industry is being impacted by heightened geopolitical tensions affecting the region over the past year.

In contrast, still limited GDP per capita, a volatile growth pattern and a relatively high, but affordable, debt-to-GDP ratio are the main constraints on the Ba1 rating. Weak labour market efficiency, limited innovation and pervasive skills mismatches limit the country’s competitiveness and constrain the growth potential of the non-primary sector. Existing capital controls and the low share of foreign-currency debt (22% of total general government debt) shield Morocco from financial market volatility that has affected other emerging markets in its rating category. Moreover, the foray of large Moroccan banks into the sub- Saharan continent presents both opportunities and risks, says Parisi-Capone.

In Moody’s view, the harnessing of significant renewable domestic energy resources is credit positive from an environmental sustainability perspective. At the same time, it permanently reduces Morocco’s balance of payment sensitivity to higher energy prices. (A detailed report on Morocco’s biggest solar energy complex is also attached.)

Morocco’s GDP-per-capita remains constrained as compared to peers at the same rating level, and the relatively high share of agriculture value added in total GDP at about 15% fuels growth volatility. However, the government is focused on increasing manufacturing as a share of the economy to 23% of GDP by 2020, from 16% in 2012. It also aims to expand its export-base and to position Casablanca as a financial services hub in the region.

Moody’s notes Morocco’s relatively high, but affordable, government debt level, which it expects to peak at about 65% of GDP this year. However, Morocco’s low exposure to foreign-currency debt partly mitigates the previous deterioration in its debt metrics, somewhat insulating the country from global financial market volatility.

Another area of focus is the government’s Vision 2020 strategy for the tourism industry adopted in 2010, which seeks to double the size of the tourism sector and put Morocco in the top 20 tourist destinations globally by 2020. However, tourism industry is being impacted by heightened geopolitical tensions affecting the region over the past year and this will weigh on the tourism industry over the forecast horizon, says Parisi-Capone.