Arab News

Ishac Diwan

Five years after the so-called Arab Spring uprisings began, Egypt, Jordan, Morocco and Tunisia have achieved reasonable levels of political stability. Yet economic growth remains tepid, and the International Monetary Fund does not expect the pace of expansion to exceed 1.5 percent per capita this year. Given the region’s large catch-up potential and young workforces, one must ask why this is so.

One obvious explanation is that, despite significant progress in building stable governments, these countries remain subject to political risks that scare private investors. But private investment was modest before the uprisings of 2011, when such risks were already high. There must be more to the story.

A look at these countries’ recent economic history offers insight into the problem. Market economies are relatively new to the Middle East and North Africa, having arisen only after the 1980s.

As a result, even as the reforms of the 1990s rolled back the state’s economic role — in Egypt, state spending fell from 60 percent of GDP in 1980 to 30 percent of GDP in the 1990s — politics continued to shape markets. With economic privileges doled out in a way that blocked the emergence of independent entrepreneurs, favored firms were able to acquire virtual monopolies over entire liberalized economic sectors.

In Egypt, for example, the firms of 32 businessmen closely closely connected with then-President Hosni Mubarak received in 2010 more than 80 percent of the credit that went to the formal private sector and earned 60 percent of the sector’s overall profits, while employing only 11 percent of the country’s labor force. In Tunisia, former President Zine El Abidine Ben Ali’s cronies received 21 percent of all private-sector profits in 2010, though their firms employed only 1 percent of Tunisia’s labor force. Unsurprisingly, this system generated only modest growth.

Political loyalty does not translate into economic efficiency, and those loyalists consistently failed to build competitive world-class corporations. And it was not only traditional rent-filled sectors, such as real estate or natural resources that failed to reach their growth potential. In tradable sectors, such as manufacturing and utilities, rents were created through non-tariff protection and subsidies, leading to anemic export growth.

The result was a dearth of jobs in the formal sector, which rarely employed more than 20 percent of the labor force. With the few good jobs reserved for favored groups, a growing pool of educated young workers faced lower-quality jobs in the informal sector. Add to that poor-quality services and social mobility ground to a halt.

Intensifying social dissatisfaction was met with rising levels of repression. Ultimately, the regimes’ inability to control both the street and the private sector culminated in popular protests and political revolutions.

The governments that emerged from the Arab Spring’s wreckage inherited a broken system of closed deals. Inadequate property-rights protection is impeding investment, but moving to fair and well-enforced rules is not a realistic prospect in the current environment, given the petty corruption of an underpaid bureaucracy and the polarized political environment.

These countries could try to replicate Turkey’s economic success in 2000-2010, when a political alliance between the ruling party and a broad group of dynamic small and medium-size enterprises (SMEs) contributed to a tripling of exports. The challenge here would be to find the right investors, who can spur growth and create jobs, not just provide political support.

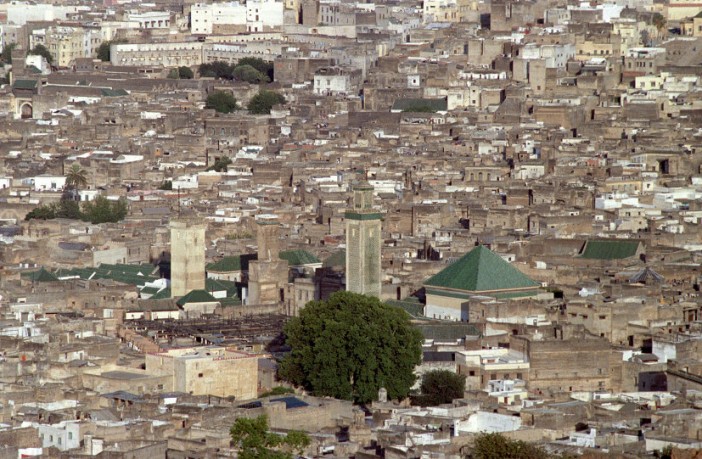

Here, Morocco and Jordan have had some success, with their governments proving capable of managing elites who offer both political acquiescence and economic sustenance. But, while these countries’ governments are having some success in broadening their business coalitions, traditional rent-seeking cronies are constraining progress. By undermining investment in tradable sectors, appeasing them means hampering export growth considerably.

Tunisia could take a page out of Morocco’s playbook, expanding its export sector by attracting foreign direct investment, while opening up its domestic services sector to local SMEs. But it would still have to face the challenge of liberalizing its economy, in the face of rising pressure from labor unions to protect inefficient incumbent firms from increased competition.

In all four countries, employment growth will remain constrained for some time to come. Improving economic inclusion without threatening political leaders will be no easy feat, as it demands the creation of more inclusive governance arrangements. For Morocco and Tunisia, the convergence of interests between moderate Islamists and liberals offers a ray of hope.